Hey my man! Been reading Jack Bogle’s book since it came in and I’m half way through it. Very interesting read for sure. On your “how to invest” story I got that part. I get it why to focus on target date index funds and automate money to be taken out my account each month. My question is since I already have 4 types of mutual funds with my advisor how do I transfer it over to vanguard and switch it to a target date index fund instead of having the funds that I have?

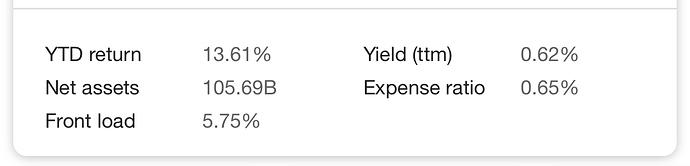

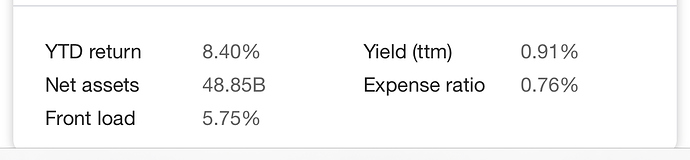

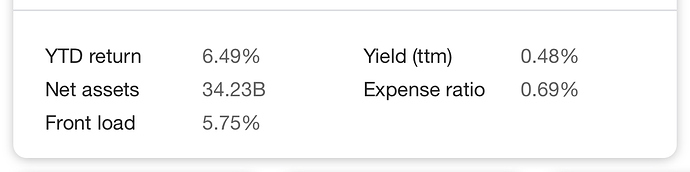

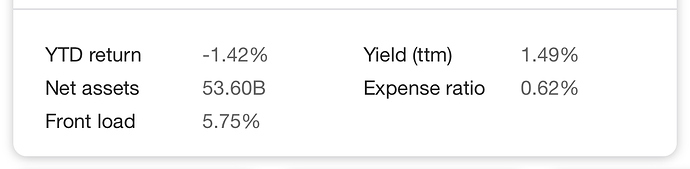

Also here are the expense ratios of the mutual funds I’m in currently. Also including the 5.6% commission my advisor receives not on the capital gains but each time I invest. Let me know your thoughts

Hey @Coop1919!

Yeah, that 5.6% up front fee is called a “load” and I would absolutely never pay a load. And for your high cover charge to get into the club, you’re then paying even more for way too expensive mutual funds (about 15X more than what Vanguard offers).

In terms of how to fire your advisor, I generally think it’s polite to send an email thanking them for their help and letting them know you’ll be self-managing your portfolio going forward and they should expect a outgoing transfer request from Vanguard. When firing employees or financial advisors, brief, fact based and to the point is usually best.

Then, head over to Vanguard, click “open an account”. They’ll ask you how you want to fund the account and you choose “from another existing brokerage” or some option like that. You may have to provide an account number or upload a statement or something. It’s not an especially fun or smooth process, but within an hour or two you’ll figure it out and it will save you a million dollars over the course of your career, so likely a good ROI on your time.  You can always call Vanguard and they can help walk you through it if necessary.

You can always call Vanguard and they can help walk you through it if necessary.

That process will take at least a few days to complete. When it does you’ll either have a bunch of cash, or those same mutual funds inside your Vanguard account. Then you simply sell them all and put all the money into a TDIF!

Thanks my man I really appreciate the advice! I won’t get taxed or anything for moving it from him to vanguard right? I’ve seen people talk about fidelity or vanguard which do you prefer?

No, if you’re going Roth IRA -> Roth IRA there should definitely be no tax. You can tell Vanguard you want to do a “direct transfer rollover”. Make sure the money from your existing account is sent right to Vanguard, not to you. It should be logged as a rollover, not a withdrawal.

Here’s a good convo on Vanguard vs Fidelity:

Gotcha thanks! Thankful that I came across you and your page from watching a lot of interviews and listening to different podcasts. I’m sure your community really appreciate the value that you give.