I’m in what I know is only a starter home, and I’m saving towards buying in the future something a bit bigger (not a mansion, just… something a bit more to my taste that would be my ‘forever home’ that I would stay in until they took me out feet first.)

Right now, I make biweekly payments towards my mortgage, so I essentially end up making an extra full payment each year on my mortgage (Monthly payment is around $1400, so every two weeks I pay $700, so instead of 12 payments/year of $1400 I end up making 13 payments/year of $700.) It works out better with how I get paid because it is less of a mental exercise to account for my budget in each paycheck (i.e. I get paid biweekly, so I know out of each paycheck $700 is going towards my mortgage.) The interest rate on my mortgage is 4.5%. The home is worth approximately $220,000, and I owe approximately $180,000 on the home.

Since I know that my home is not my ‘permanent’ home, I’m wondering if it makes sense to keep doing this since the long-term effect may be negated by the fact that I very, very likely won’t be in the home for the life of the loan.

One other note: my home is a townhouse in an area that has a lot of townhomes. I’m concerned with my ability to sell once I’m ready to move, as the market is a bit saturated and it may make more sense to rent out the house instead of trying to sell.

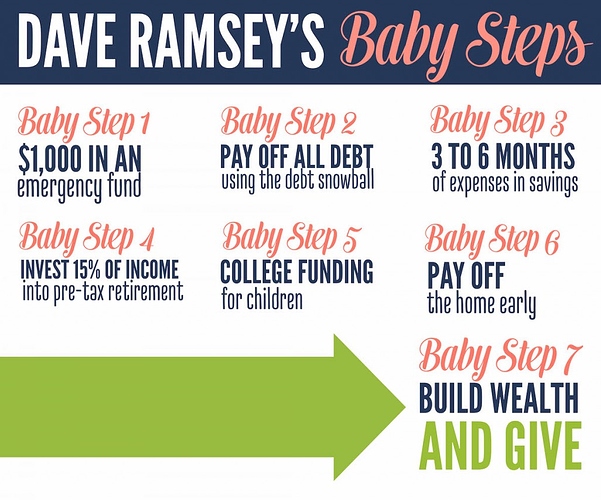

) because that OTHER person with their baby steps just didn’t make sense to me. I mean, why wouldn’t you max out your 401K to what your employer matches??? That is free money that you’re losing if you don’t take it all. And saving $1k first over everything… how does that help? I didn’t get it. I feel like your steps fit me better.

) because that OTHER person with their baby steps just didn’t make sense to me. I mean, why wouldn’t you max out your 401K to what your employer matches??? That is free money that you’re losing if you don’t take it all. And saving $1k first over everything… how does that help? I didn’t get it. I feel like your steps fit me better.