Hey Jeremy, I am a beginning investor who has started reading the entry level investment books. I’m having trouble deciding where to take my money to start investing. I read an article about this new investing app called titan that is supposedly beating the marketing. My question is how did you decide where to take your money and choose what account you wanted to start investing with and how has it changed since you started?

Hi Trev! Not Jeremy but here’s some 2-cents… Looking ahead, this reply might get a little lengthy and opinionated. Short answer: I would say your money is better invested in a low-fee index fund (less than 0.3%) in your Roth IRA instead of a taxable or regular IRA. There’s no reason you would want your personal IRA to be subject to a 1% fee, that will eat up your earnings if you stuck with them long term.

Long answer: For those of you reading this other than Trev, Titan Invest is a app in which you can invest money automatically adjusted to hold 20 different stocks. These stocks are chosen based on an algorithm which monitors large hedge fund filings. Titan’s requirement for stocks are the following…

- Wide moat

- Strong cash generation

- High returns on capital

- Excellent management

- Attractive growth prospects

I found these requirements on this website’s discussion of the platform. I could not find any information about their stock requirements written on the actual app’s website. Suffice to say, these requirements are pretty vague and subjective. Of course it could just be a summary of a much larger financially savvy white paper describing the company’s practices, but that was not on their website.

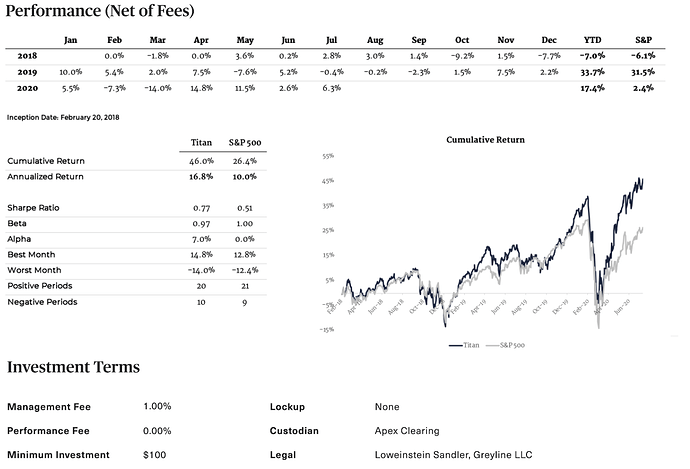

Now, this fund does claim to beat the S&P500 and as of now, that seems to be true… This is an image from Titan Invest’s “Flagship Tearsheet” updated as of July 31, 2020. Right off, it is beating the S&P500 by 15%. However, reminder that the NASDAQ is YTD (8/14/2020) up 23%. So, Titan could very well just be holding a large amount of tech stocks during a strong tech run.

Additionally, check out the previous months, there isn’t a month by month comparison of performance compared to the S&P500 which also could be telling. This app definitely invests with risk in mind, so you should be ready for some really bad months and really good months if you choose to invest with them. Also, 2.5 years is a VERY short time to claim solid returns. Starting an investment platform halfway through a very strong “bull market” was some planning and some very good luck.

Lastly, this company bases investing on leveraging shorting of stocks (0 - 20%) within your portfolio. There are a lot of vastly varying opinions on shorting stocks, the risk vs reward is once again high. Personally, I would stick with the 3-fund portfolio and index funds. It has a proven track record of decades and it will take good care of you with early and regular investments.

Seven reasons to put 100% of your portfolio in a target date index fund

Three-Fund Portfolio

What @dgurgan said. I absolutely wouldn’t invest like that.

You might also ask about the 9 other strategies that lost to the S&P 500 over the last 3 years. But you’re not asking about those. Do you know why? Because they lost. But 3 years ago, did you know this strategy would be the one out of 10 that would outperform? Or are you just chasing past performance and suffering from survivorship bias because looking backwards it seems to have worked. If we fast forward 20 years, comparing Titan to an index fund, I would bet the index fund wins. And I literally do bet that. With the millions of dollars I use to buy and hold index funds.