Hey @Justin_Nagel!

Well, broad strokes you’re doing awesome. You’re buying and holding index funds. If you keep putting lots of money into that over the course of your career you’ll do great. But in the interest of better understanding, let’s break down your portfolio:

-

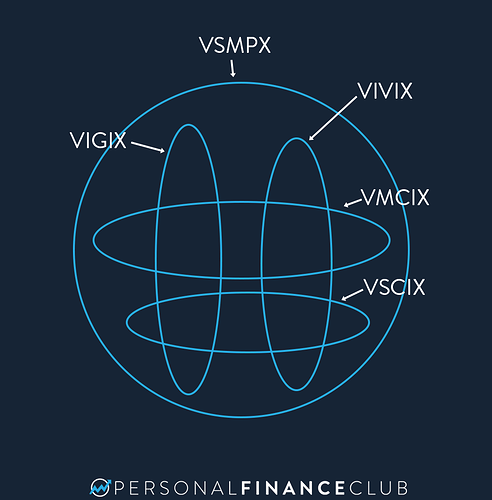

Vanguard Total Stock Index Fund VSMPX: This represents the “total US stock market”. Basically every publicly traded company in the US. 3,529 stocks at the moment.

-

Vanguard Mid Cap Index Fund VMCIX: This represents “mid size” companies in the US stock market. It contains 357 stocks. This is a subset of VSMPX

-

Vanguard Mid Cap Index Fund VSCIX: This represents “small size” companies in the US stock market. It contains 1,388 stocks. This is a subset of VSMPX

-

Vanguard Growth Index Fund VIGIX: This represents “growth” companies in the US stock market. It contains 269 stocks. It’s essentially the opposite of VIVIX. This is a subset of VSMPX

-

Vanguard Value Index Fund VIVIX: This represents “value” companies in the US stock market. It contains 347 stocks. It’s essentially the opposite of VIGIX. This is a subset of VSMPX

Did you notice any trends there? Basically you bought the entire stock market in VSMPX, then bought building blocks of it as well. It’s like if you were trying to have a diverse set of NFL helmets, so you bought an NFL complete helmet set, then you bought an AFC helmet set, then you bought an NFC West helmet set, then you bought an NFL playoff teams helmet set. You could have just stopped after the NFL complete set. Everything else is just doubling up.

I also drew you a picture:

Basically, you don’t need to do all that haphazard stuff in the middle if you own the big circle on the outside.

BUT. Those 5 funds have something else in common. They’re all US stock index funds. You DON’T have any international stocks and you don’t have any bonds. Having some of those other two asset classes could provide less volatility and potentially higher returns (although, some wise, altruistic, experienced investors believe that 100% US stocks is just fine)

So if IT WERE ME, I’d probably dump everything but the total stock market fund, then likely add at least a portion of international and bonds. Take a look at the three fund portfolio page to get an idea of how that would look: