I got this letter from my company telling me that I can only contribute 6% for my 401k. I was able to contribute 20% for about 4 months until I receive this letter. It is so frustrating that I can’t even save for my retirement. Before I was able to contribute $700-$800 per paycheck now $250-$300 and the rest goes to taxes. The difference did not reflect to my take home $. Need help, any suggest of what to do? Alternative? Plssss. Thank you!

You can only contribute max of $19,500 for 2021 pretax and Roth to your 401k. If you want to contribute more, you need to contribute as after-tax contributions- the limit for that is $58,000 – only if your company offers after-tax option. Additionally, look into traditional IRA, Roth IRA, and HSA for tax saving advantages if you haven’t max those out yet this year.

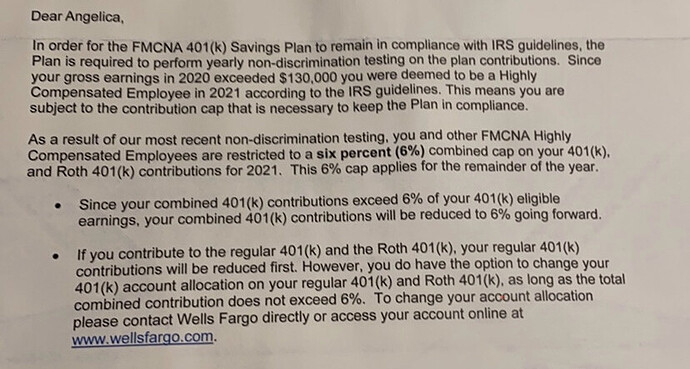

I haven’t maximized my 401K yet, I only had the chance to put as much as I can for 4 months this year then I receive that letter April 30, 2021 telling me I can only contribute total of 6% both pre and after tax. My year to date contribution as of right now is only about $11k. I have Roth IRA under fidelity. What is Roth with $58k limit?

After-tax and Roth are 2 different types of contributions. If you havent reached $19,500 limit in your 401k this year, then you should follow up with your employer to understand why they’re forbidding you the right of any employee. HCE are able to contribute $19,500 into 401k as pretax or Roth just like anybody else.

I talked to HR and they said it’s IRS policy

Hey @geeghel05!

I think that notice pretty much means what it says. There are rules in place with 401ks such that they’re not just secret tax havens for the rich owners. If they check and find out only the “highly compensated” employees are taking advantage, then the whole plan is not in compliance and you get limited.

So… it is what it is. You could talk to your boss/HR to try to whip them into shape to get your full $19,500 limit back. (This would probably require offering a better match/training to lower income employees) But at the end of the day you just take advantage of what tax breaks you can and put everything else into a taxable brokerage account. You absolutely SHOULD be seeing an increase in your take home pay… if the money isn’t going into your 401k account it should be coming back to you. I suspect it is, but I’d want to look at those pay stubs and transactions/balances on your 401k pretty closely to make sure something isn’t going wrong.

If it were me, I’d just be dumping even more into a taxable account. See the post below. Skip steps that don’t apply and move to the next one once it’s filled up.