Hello and thanks for your post on choosing a plan for your 401k . I have my 401k being manage and looking the cost I going to drop the advisor. They are basically invested me in 3-4 index funds large cap - small/mid cap. Foreign and large cap a&o 500. With that said my question is my plan allows me to invest in pretty much anything I want to based on my discussion with Fidelity. So would you recommend me staying with normal index’s or me researching a ETFs that Choosing 1 or 2 or got back to a normal target date fund… I going to just research my options and from you post looking for general opinions about how I should research… I am looking for someone bounce the ideas of off. Great information and thanks for sharing

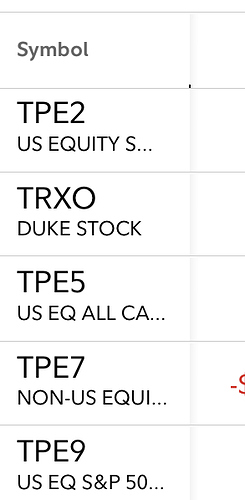

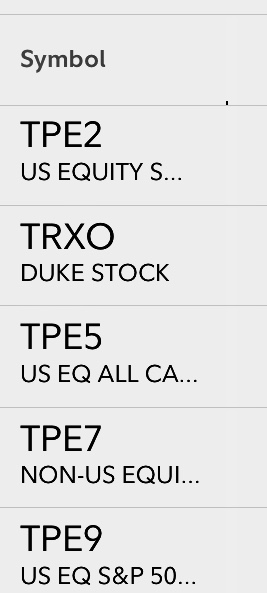

Here is my current mix below