Hi All,

I recently opened a Roth IRA, purchased a fidelity freedom 2055 index fund and maxed it out for 2021/2022. Felt super confident with my decision after everything I’ve learned from this community.

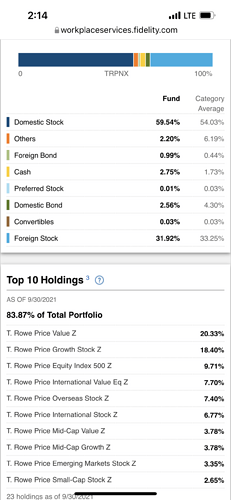

Here’s my issue, I’m now looking at my options for my 403b and I’m unsure if I should go with a 2055 target date fund offered at .46% fee (TRPNX) or if I should attempt to create my own 3 fund portfolio with the few fund options available. I love the idea of the target date index funds but unfortunately none are offered in this case.

Individual funds offered are:

Vanguard 500- VFIAX -0.04%

VIMAX- 0.05%

VSMAX-0.05%

Vanguard bond-VBILX- 0.07%

International- RERGX- 0.46%

Would love some educated opinions!