Hey everyone.

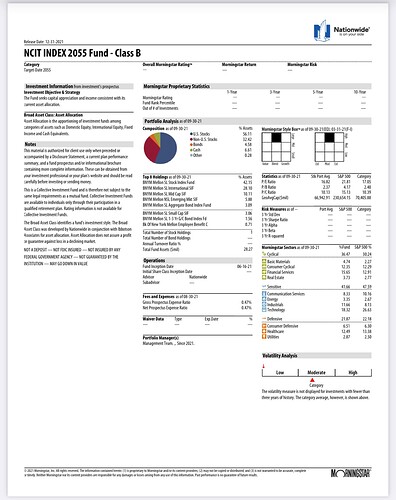

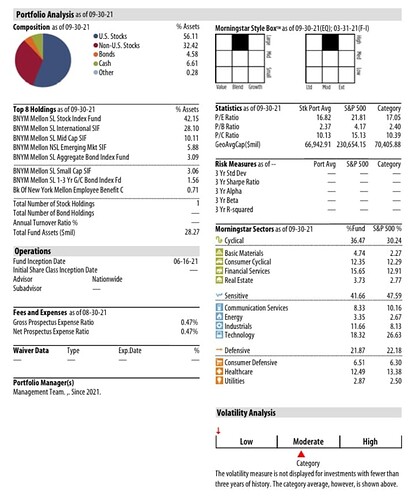

I work for local government that has a mandatory 7% investing into a retirement account, but also offers a 457b that I currently put a little money into. Since taking Jermey’s excellent course I have sense place my money into an NCIT Target Date index fund (Year 2055).

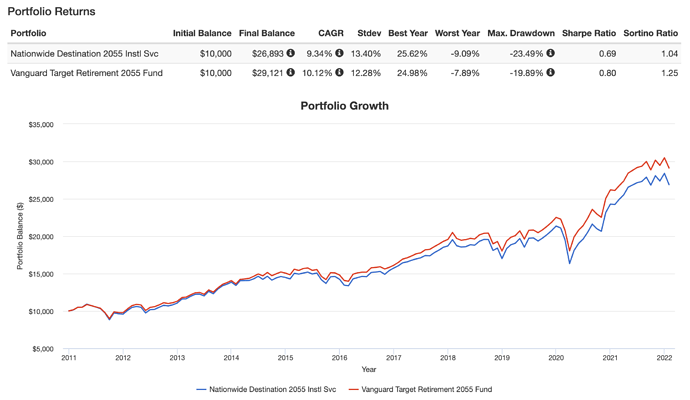

My question is if there is anyone familiar with Nationwide as a whole and if I am investing into a quality fund? When I search on google for NCIT Index and review the fact sheet it doesn’t quite give me the “warm and fuzzies” like my Roth IRA with Fidelity does showing clearly what I am investing in.

I may be overthinking this, but I just want to make sure I’m in a good fund before dumping significant money into it.

Side note: My job also offers investing with Voya’s 457b.

Any assistance would help! Thanks for reading!