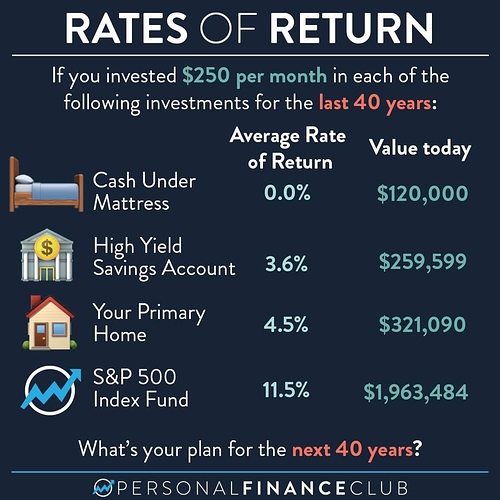

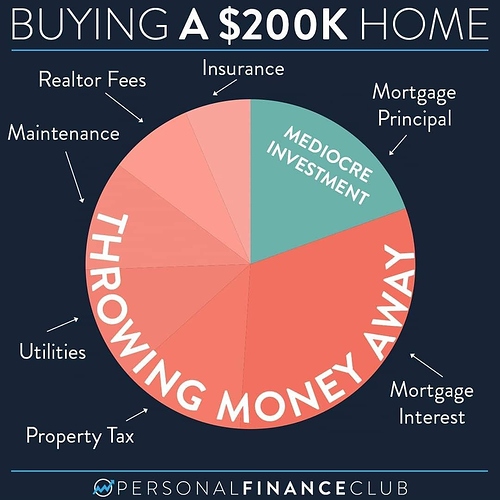

According to several Instagram posts, the average home price increases 3.5-4.5% annually. However, where is this statistic coming from? I have seen several other statistics online that say it is closer to 9%. I realize this is only considering the principle, and not all the other sunk costs of homeownership. But strictly speaking, what is the true ROI on the principle of a primary residence? 4% seems low. That’s barely more than inflation. (I’m not asking about investment real estate, just a primary home) Thanks!

I also do not own a home. I am trying to explain to my homeowner friend the hard truth that his home is not an investment. Zillow usually has market percentages of local areas but I don’t think it‘a getting through to him. People who buy homes suddenly think they are Donald Trump.

Hey @Shae_Bryant!

I generally rely on the S&P/Case-Shiller U.S. National Home Price Index. That tracks the price changes of “same home sales”. So it’s how much you might expect your specific home to grow in value. The full time frame of that index (1987-2020) has shown an annual growth rate (CAGR) of 3.73%.

One stat that might skew these numbers is that homes in general are getting bigger/more expensive. i.e. new homes built today are much bigger than new homes built in the past. So therefore the “average” home today is more expensive than the “average” home 40 years ago, even relative to the above index. But a SPECIFIC home isn’t going to take advantage of that growth, because unlike debt, toddlers and this weird mole on my arm, your home doesn’t keep growing on its own.

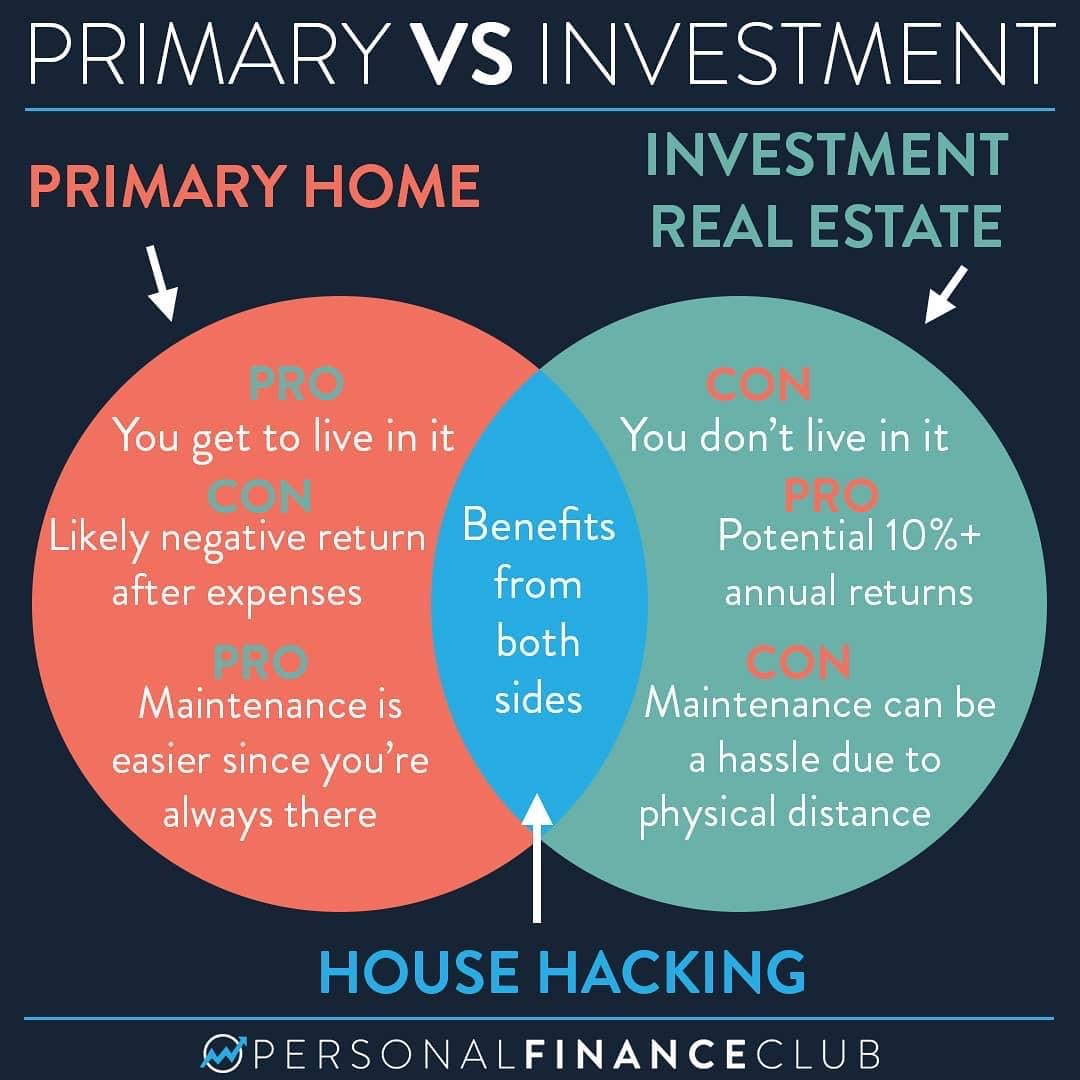

And yes, as you mentioned, that 3.73% is BEFORE the expenses of property taxes, mortgage interest, realtor fees, maintenance, insurance, etc. The actual return on a primary residence is negative by a few percent per year. As always, that doesn’t mean NEVER to buy, it’s just good to go into it with your eyes wide open realizing that buying more house will make you less wealthy, not more wealth, assuming you wisely invest the difference.