One question, when you are talking about Vanguard ETF you are referring to VTI ya? So basically when i wanna purchase I will purchase the VTF ETF which is currently traded at $172 per ETF? I do have to give a fee of $25 each time I purchase so i need to do in bulk and less frequently per year as I am outside US in Singapore

Hey @Abrar_Siddiquee!

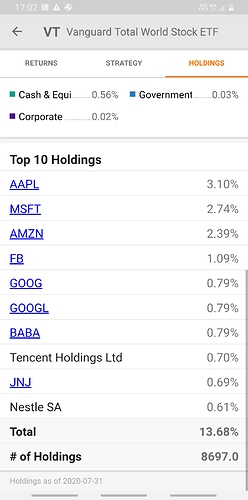

Yes, VTI is a great “Total US stock market” ETF offered by Vanguard. Since you have really high transaction fees, you’d probably benefit from having fewer ETFs, so I’d suggest looking into VT which is a total world stock market ETF. Basically buying that one ETF guarantees you your fair share of the growth of all publicly traded companies in the world!

And yeah… $25/trade is crazy high. In the US it’s $0. I certainly think losing more than 5% of the value of the ETF you’re buying is crazy territory, so I would want to be investing at LEAST $500 at a time. Probably $1,000+ would be better. Just save it up in cash, then make big purchases of 10+ shares at a time (for example). VT is currently trading around $81, so you should be able to utilize more of your cash when you buy.

Hi @Jeremy thanks for the replies and suggestions. I was checking out both VTI and VT. As per the two screenshot you can see VTI has higher percentage of blue chip stocks compared to VT. Ami I right? If thats the case is investing of VTI along with VT also a good idea as VTI has more of the percentage of blue chip stocks like the FAANGs? Please kindly correct me if I am wrong !

Screenshot_20200820-170242_Seeking Alpha|248x500

And 30% dividend tax as well right!!

Hey @Abrar_Siddiquee!

You’re wrong! Ha! Well, not necessarily wrong. But I don’t think it’s a good thing to pick VTI because it has more concentrated holdings on those FAANG stocks. We can’t know if those are going to outperform going forward. I think you like those because they have done well in the PAST but that’s chasing past performance. Instead of buying what did well in the past, we want to buy what is about to do well for the next few decades. Since we cant’ know that, we want as diversified as approach as possible, which is why I prefer VT over VTI. VTI is 100% US stocks. If the US has a bad decade and the rest of the world does great, you don’t want to be holding only the dud, you know?!

Thanks so much Jeremy. Appreciate your time to share the knowledge. Grateful