Originally published at: https://www.personalfinanceclub.com/can-i-become-a-millionaire-as-a-teacher/

Teachers are underpaid. I believe the long term solution to all of the world’s problem is education. And we should be paying teachers to reflect that.

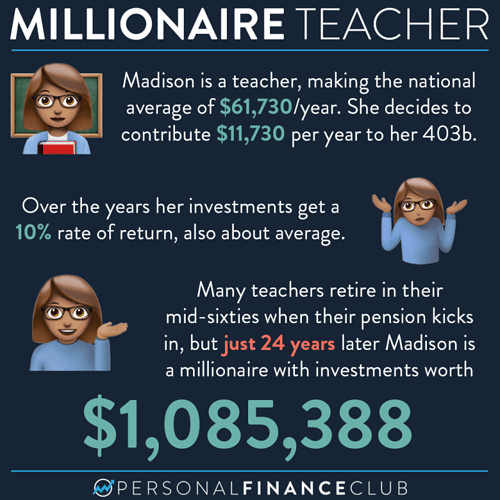

But still, it’s not like teachers make NO money. In 2019 the average US teacher salary was $61,730. Pretty close to the median US household income of $68,703 (which often has more than one income earner).

So Madison here decided not to wait her entire life for her pension to kick in. She took that $11,730 off the top and put it into her 403b. (Which is like the teacher version of a 401k). Since it’s a traditional 403b, she was only taxed on the remaining $50K/year, giving her a lean cost of living, but she made it work.

And for her financial ambition, she was rewarded! Hitting millionaire status in her mid-forties. Instead of working ANOTHER twenty years waiting for her pension, Madison has options! Maybe she can teach part time, and work more on her hobbies. Or switch careers for the second part of her life. Or keep teaching because she loves it and go on more fancy trips or be outrageously generous! I don’t know what Madison is going to do with her money, that’s her business. But she crushed it.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram