Originally published at: https://www.personalfinanceclub.com/can-i-still-contribute-to-my-2020-roth-ira/

A Roth IRA offers a really good deal on taxes. Anything that is in there grows FOREVER without any additional tax. So if you contribute $6,000 this year and it grows to $60,000 at retirement. You can take it all out with zero taxes owed and spend every penny!

But here’s (one of) the catches: The government gave us this deal because they don’t want a bunch of broke old people. But they also don’t want to give millionaires an unlimited tax shelter. So there’s an annual contribution limit. For 2020 and 2021 that limit is $6,000 per year. So if you make a million bucks, you can only put $6,000 in an IRA for this special tax treatment. (And if you actually make a million you’re not eligible at ALL to contribute to a Roth IRA, although you can do a backdoor Roth IRA. And also, if you make a million dollars please Venmo me fifty bucks).

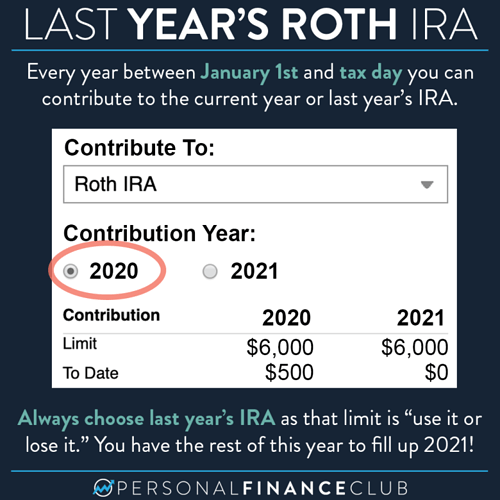

And the friendly US government also knows that we’re a country of procrastinators. So they’ve cut us yet another deal. They said AS LONG AS YOU CONTRIBUTE before tax day of this year (where you report your IRA contributions for last year) you can count those contributions towards last year’s limit.

So today in March if you are contributing to an IRA, choose to count that towards your 2020 contribution limit. Because that option is going to disappear on April 15th, then you have the rest of the year to fill up 2021.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram