Hi!

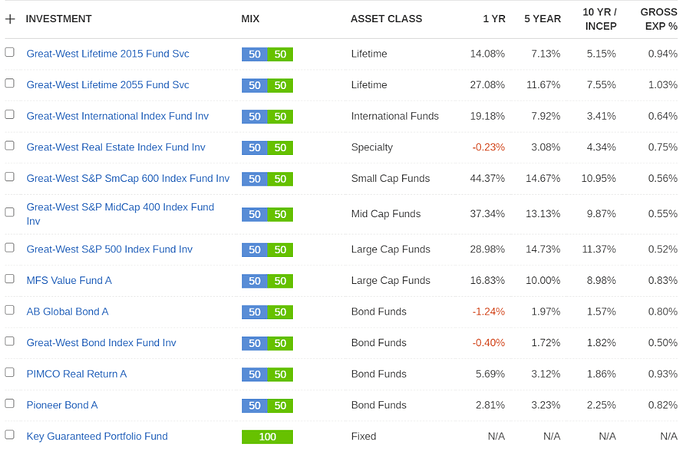

Just as I finished the amazing course, my wife’s employer provided her with a 401(k) plan. The expense ratio of the TDFs are all above 1%, so I’m trying to decide how to invest in the Index Funds they offer (which are all around 0.5%-0.6%). Should I diversify between Large/Mid/Small cap Indexes or go for S&P, International and Bonds Indexes? Or maybe invest everything in the S&P Index Fund?

Btw, all funds are Great-West funds (no idea if it means anything).

Thanks!