Hi @Jeremy and everyone else,

I’m starting to get more involved with my current investments and planning for additional investments, and have a few questions.

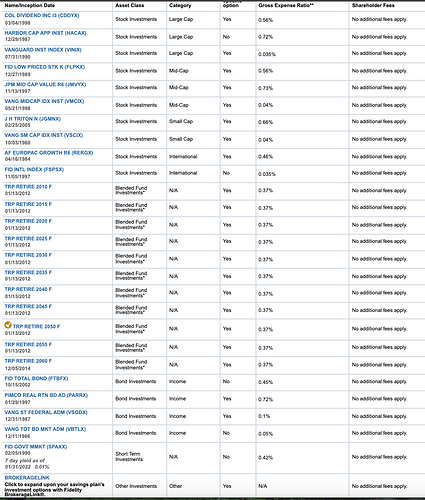

My 401k through my employer is with Fidelity NetBenefits and I’ve been contributing to it for a few years now. Back when I set it up, I pretty much had no idea what I was doing so I chose an investment with little to no knowledge about it. I’m currently 100% allocated to this: TRP RETIRE 2050 F

-

Is this considered a target date index fund? I can’t seem to find it labeled anywhere as an index fund but It has a fairly low expense ratio of 0.37%.

-

My employer matches contributions up to 5%, so should I contribute the same 5% or go higher? And should my contributions be pre-tax, Roth, or after-tax? I was thinking I would match my employer at 5% and put an additional 5% or so in a Roth IRA with a target date index fund.

-

I have 27 investment options to choose from. Would you recommend sticking with my current investment or change to one/some of the available options?

Thanks,

Eric ![]()