I completed the course and it was great! I left a review also

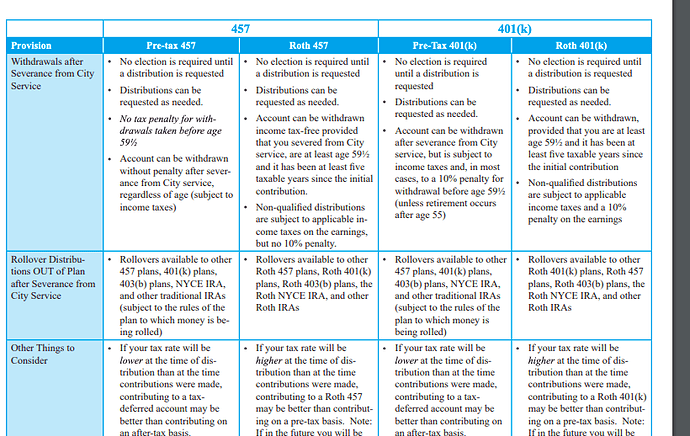

I have a few follow-up questions. Currently 26 years old and this stuff gets me excited! I currently contribute to a PreTax457 with no match. I am a local government employee and I am eligible to retire in 20 years with a pension. The perk of the 457Pretax is that I have access to all the money without penalty upon retirement. Is pretax better in this situation and does a pension affect anything with rollovers etc?

The city I work for and my insurance plan don’t have an HSA but an HCFSA? I am not sure of the difference but from brief research, I think it is different and a use it or lose it type deal.