I opened a Vanguard Roth IRA in 2020 investing in VFFVX (Target Date Retirement Fund 2055). I opened my account in March 2020 with $1000 and recently started contributing to max out 2020 (currently at $5500) and then will begin maxing out 2021.

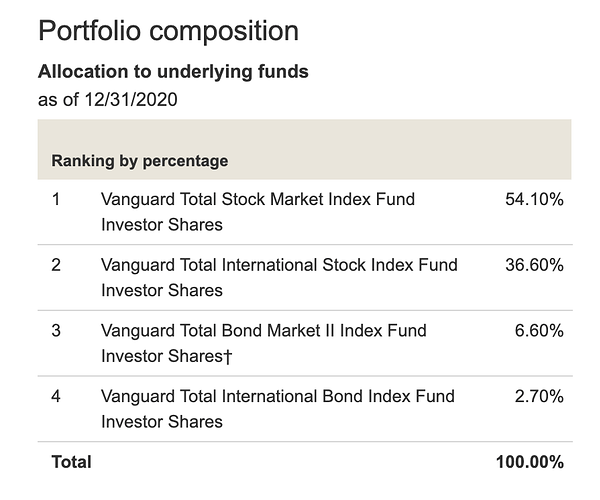

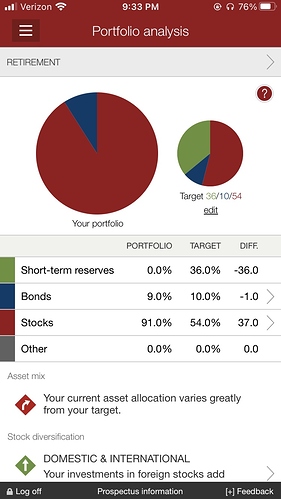

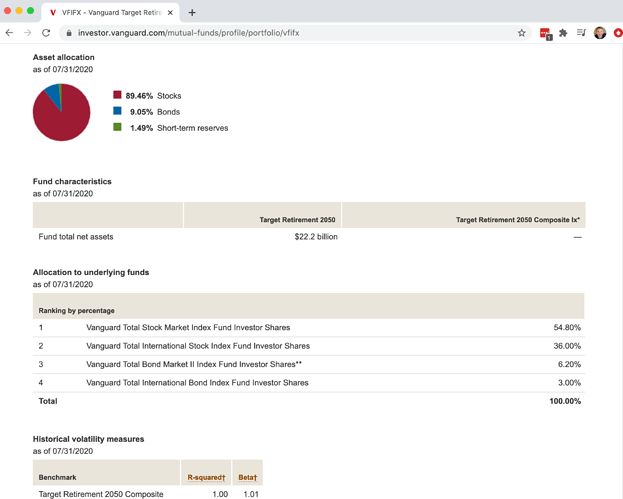

From my understanding, by picking VFFVX, the asset allocation will adjust itself accordingly as I approach retirement. Right now the target allocation is 54% stock, 10% bond, and 36% short term reserves.

However, my current portfolio is 90% stocks, 10% bonds, and 0% short term reserves. I am very confused by this as I thought VFFVX automatically sets this up for me and should be 54/10/36%.

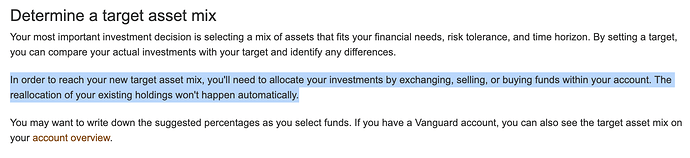

I’m now thinking that when I opened this account last year, I probably mistakenly set it at 90/10? How can I fix this?

Thanks in advance.