Hello Jeremy,

I established a Roth IRA years back w/ a Financial Advisor when I had very little knowledge on the benefits of index funds as opposed to mutual fees with high fees. I am 31now and have roughly 32k in American New Perspective. The break down is 27k in NPFCX, 3.6k in ANWPX, and 1.5K NPFFX respectively.

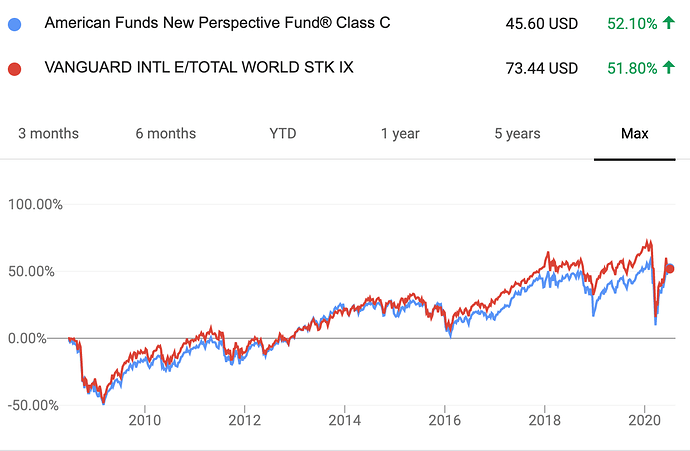

Over the years, contributions have been allotted into those three different funds for different reasons over time where I paid front load and back load fees which seem little at first glance… I used to contribute money each month but stopped recently and going to redirect to my Vanguard acct instead which i established a couple years ago. For long term efficiency, do you recommend that I transfer the mutual fund acct at Edward Jones now to vanguard ? How can i do a side by side comparison?

Would you recommend i do an “in-kind” transfer to vanguard and then sell my position so i can reinvest those funds in vanguard index funds? I appreciate your insight. Thanks!