My reason is because they are the only ETF that has a zero expense ratio. Management fee at.19%

Interesting, looks like a pretty new fund (at least on Fidelity research). Due to their large holdings in Amazon, Microsoft, and Apple they recently have beaten the S&P500 fairly handily. I think its got a great $$/share price, especially for those who don’t have a ton of cash to thrown around. Could be a solid purchase. ETF’s are generally designed to follow the market, so I don’t know how much better it would be compared to a zero-fee fund like FZROX. What else do you like about this ETF compared to others?

The reasons that I like this ETF is because the price is right and it got potential to growth. Secondly I compare this SFY to ITOT ETF which ITOT is similar but is trading at $70. Getting in early at this price now within the next 5 to 10 year there’s a great chance this going to quadruple in its stock price.

Hi @mikesaunders,

It sounds like you have a core misunderstanding of how share price works. Share price is totally irrelevant when compared to any funds except itself. When you suggest:

Getting in early at this price now within the next 5 to 10 year there’s a great chance this going to quadruple in its stock price.

That’s just simply not how ETFs, index funds or share price works. As of this writing, SFY is at $11.39 per share. ITOT that you mentioned is at $70.60. But those simply can’t be compared to each other. If you invest a set amount of money in SFY or ITOT you will own the exact same proportion of the underlying stocks. And you will experience nearly identical growth. i.e. if SFY goes up 4x in price, so will ITOT. That would mean SFY would trade at about $44/share and ITOT would trade at about $280/share.

You often don’t see share prices as high as $280 on ETFs because the managers want the share prices to be accessible to individual investors… so if it gets that high, they split the stock. So if you owned 1 share at $280 and it did a 4:1 split, you’d log into your account and see 4 shares worth $70 each. You still own the same amount of stock, worth the same, they just manipulate the size of the shares to make them easier to trade.

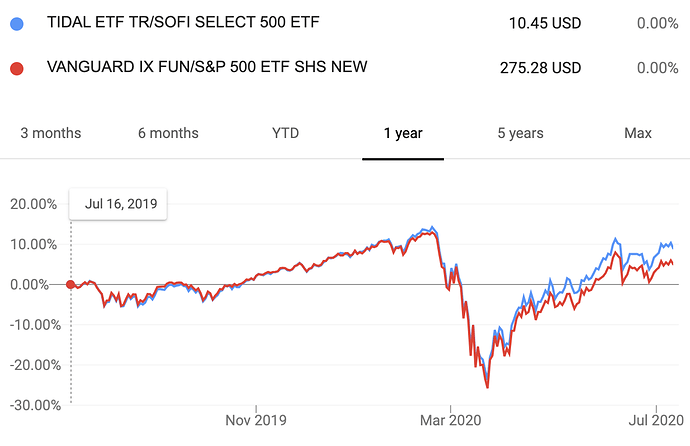

That said, it looks like SFY is probably a fine ETF that will perform about as well as any other S&P 500 ETF. Here you can see it compared to Vanguard’s popular VOO:

The slight outperformance might be due to tracking a slightly different underlying index (i.e. the 500 biggest companies, not the S&P 500, which doesn’t include companies like Tesla). That said, I wouldn’t count on it continuing to outperform in the future.

Take a look at these two posts that might help you.