Hey guys,

I have been following PFC for a few months, discovered Jeremy’s post on Reddit and the journey so far has been such a joy and an eye opener.

In the majority of the post, Jeremy says to pick the ETF with the less annual fee, which I understand. But for me, fees should be also compare to the fund results.

Let me give you an example: EURO 50

There’re 2 funds I’m interested, that follow the EURO 50 index, both with cumulative dividends.

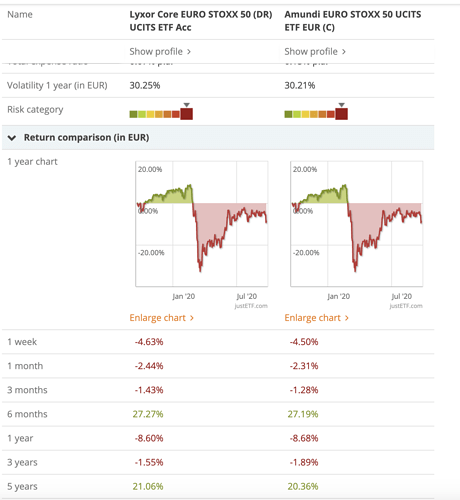

- Lyxor Core EURO STOXX 50 (DR) UCITS ETF Acc

- Amundi EURO STOXX 50 UCITS ETF EUR ©

Lyxor’s fee is 0.07% PA, and Amundi is 0.15% PA.

But both do not deliver the same exact return:

So, in my head, I should go for the one with the highest (CAGR - Annual Fee), because it’s what matters in the end.

What do you think?