Originally published at: How can I retire before 65? – Personal Finance Club

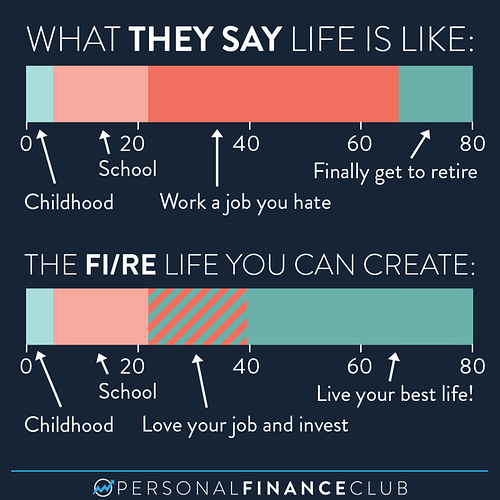

The US government defines “full retirement age” as 67. If you go to high school and college you’ll probably graduate around 22. That leaves a 45 year working career. And what do you get for that? A tiny social security pension representing a fraction of your working salary. And just in time to die a few years later. That’s not a system I want to sign up for.

WELL GOOD NEWS. You don’t have to do it that way. Instead of waiting for whatever social security is gonna pay you when you’re old, you can decide to retire on your own terms. As soon as you have saved up 25X your annual spending, you can officially live off of your investments forever. If you save half of your take home pay, that will get you there in about 15 years. 15 years of work then maintaining your same standard of living sure sounds better than 45 years to live off a small government check!

FI/RE stands for “Financial Independence / Retire Early”. It’s basically reimagining what the word “retirement” means. It’s taking control of your own spending and investing to live your own best life.

I was fortunate enough to retire at 36! Now instead of dragging myself to a job I hate, my days are filled trying to figure out how to maximize my life value! It doesn’t mean I don’t have problems, but I’m sure glad money isn’t the restraining factor on every decision I make!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram