Originally published at: How do I get started with investing? – Personal Finance Club

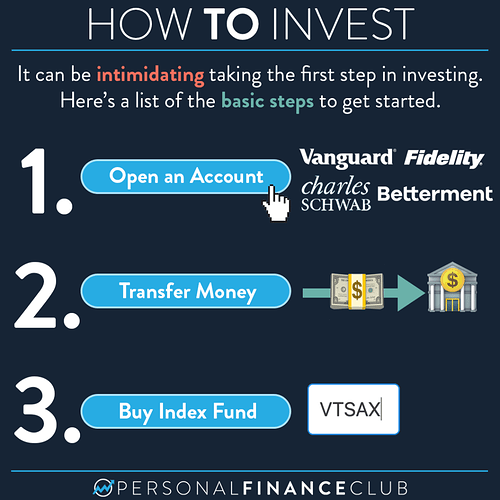

Dipping a toe into the world of investing for the first time can be extremely intimidating. Images dance in your head of wall street traders frantically waving pieces of paper, pork bellies futures, options contracts, bitcoin, day trading, and whatever the hell forex is. How do you know where to start?!

Well here’s the thing. All of that complexity is nonsense. Optimal investing is simple investing: Instead of putting your money in a bank account, you buy a piece of the economy in a convenient package called an “index fund”. Then you do nothing else except for buy more and wait.

That’s it. That’s investing. The more I learn about it the more I realize there is no “advanced” way to get a better return. There’s just a lot of complexity that funnels money into the pockets of the financial services industry. But the simple way is the way that is most likely to maximize your wealth.

So let’s break down these steps:

- Open an account. Go to the website of any of those brokerages above. They’re all good. Pick one you’re comfortable with. Click open an account. (You can open a Roth IRA that will offer a tax savings or a regular account).

- Put money into the account. You link it to your bank account, just like Venmo.

- Buy an index fund. They have ticker symbols. VTSAX is one such index fund offered by Vanguard that tracks the total US stock market. I also love “target date index funds” and list the ticker symbols here.

THAT’S THE IDEA. It really is that simple, although I do recommend learning the “why” behind this process. Being confident in what you’re doing will set you up for a lifetime of successful investing. It takes a few hours to learn and will make you a millionaire. It’s worth it.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram