Originally published at: How does a Backdoor Roth IRA work? – Personal Finance Club

I get this question all the time (respect to all you high income earners!) so here’s the post!

First, let me be clear, this post is totally irrelevant to you if you make less than $125K as a single tax filer or less than $198K as a married couple filing jointly. If you’re under those income limits, you can open and contribute to a regular Roth IRA.

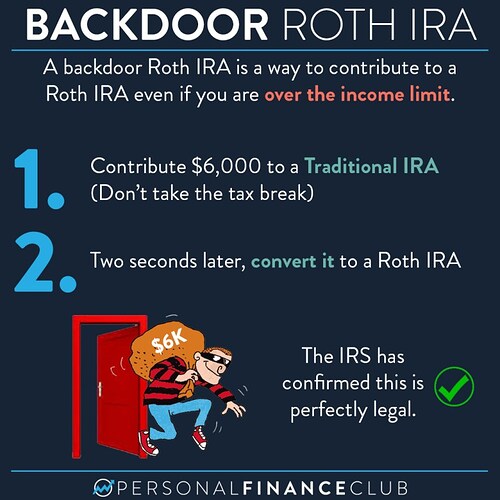

The government (tried to) limit the Roth IRA benefit to low and middle class income earners, so they installed these income limits. But here are two things that are still legal at any income: Making a non-tax deductible contribution to a traditional IRA and rolling over a traditional IRA to a Roth IRA. A Backdoor Roth IRA is simply using that strategy to circumvent the Roth IRA income limits.

It’s a tax loophole. Everyone knows it. The IRS confirmed it’s perfectly legal. Yet we still operate under the fantasy of these income limits.

The process is pretty easy. Go to a brokerage like Vanguard, Fidelity, or Schwab. Make a non-tax deductible contribution to a traditional IRA. Then immediately convert that Traditional IRA to a Roth IRA. Boom. You have money in a Roth IRA.

There is a little catch. If you ALREADY have money in a traditional IRA that is untaxed. You can’t do this so simply. There’s a “pro-rata” rule that means you can’t convert JUST that new untaxed money. You have to convert $6K of the total money proportionally. Which means you’re gonna have to pay tax on some of the conversion.

All that said, BIG PICTURE, I don’t think this is really that big of a deal. If you’re making $200K/year, $6K is only 3% of your income. You could be investing a LOT more in a 401k or a regular brokerage account. Missing out on one little tax break ain’t gonna move the needle that much. If you just plow money into a brokerage account in a target date index fund you’ll be rich, taxes be damned.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram