I had a Primerica member approach me. In trying to get me to invest with them, they claimed that only Primerica has investment accounts that can yield more than 10% gains (as high as 13%) and they said this is AFTER taking their commission. I don’t believe for this to be true. Would love to learn more on the why. Thank you!

Hey Jessyl!

Well, congratulations on your skepticism because I also am very skeptical of those claims. You were kind enough to share with me the two specific funds that the Primerica agent claimed to beat the market, so let’s look at them here.

- Franklin DynaTech A (FKDNX): This fund carries a 5.5% front load (fee you pay when you buy) and an expense ratio of 0.86%.

- Invesco American Franchise A (VAFAX): This fund carries a 5.5% front load and an expense ratio of 1.01%.

For starters, I would consider both of those very high fee funds. And realize that your Primerica agent pockets much of those fees. Consider his conflict of interest and his motivation behind promoting these high fee funds that pay him a commisison.

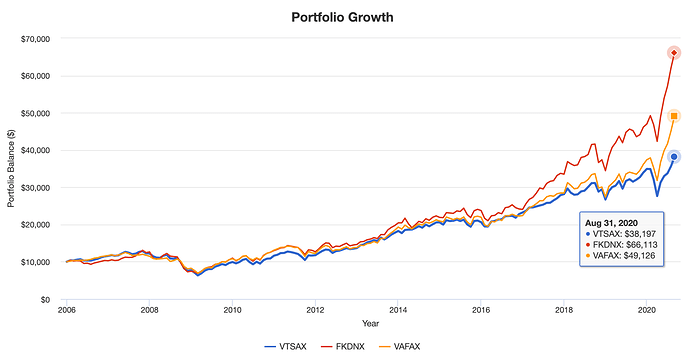

Ok, but if they outperform the market net of fees, who cares, right? Well, let’s take a look. Here’s how FKDNX and VAFAX did vs the total stock market over the last 15 years:

Sure enough, they did outperform. But one problem is that this doesn’t take into account the front load. So remove 5.5% from all the contributions, and the outperformance is much more narrow.

But there’s another big, gigantic, massive problem. 15 years ago Primerica had hundreds of different funds from which to invest in. Of those hundreds of funds, 92% have since lost to the market. Now with the benefit of hindsight, they point to the two funds that happened to be winners and say “see, we can beat the market.” But if you buy those funds now you’re just buying high and chasing past performance. Statistically, there’s absolutely no reason to think these will continue to outperform. We just had a tech boom, so (again, with hindsight) he sent you some tech-heavy funds that (barely, net of fees) outperformed and is trying to suggest that will imply future outperformance. It won’t. In fact with fees and loads you are extraordinarily likely to underperform the market.

When tech crashes and there’s a biomedical boom (for example), guess what funds he’s gonna sell to new investors after the old ones got burned on tech?

TL;DR: They can’t reliably outperform going forward, he’s just showing you what outperformed in the past and hopes you think this will happen again in the future. It won’t.

Suggested reading: The Little Book of Common Sense Investing