Originally published at: https://www.personalfinanceclub.com/how-much-cash-should-i-hold-in-my-checking-savings-and-investment-accounts/

A couple rules of investing I’ve adopted from the Bogleheads are as follows.

1. Never bear too much risk

2. Never bear too little risk

Bearing too much risk, would be something like putting every dollar to your name in a single stock. If that stock goes down (our out of business), you’re ruined! Bearing too little risk would be, in an extreme example, keeping all of your money under your mattress without giving it a chance to grow.

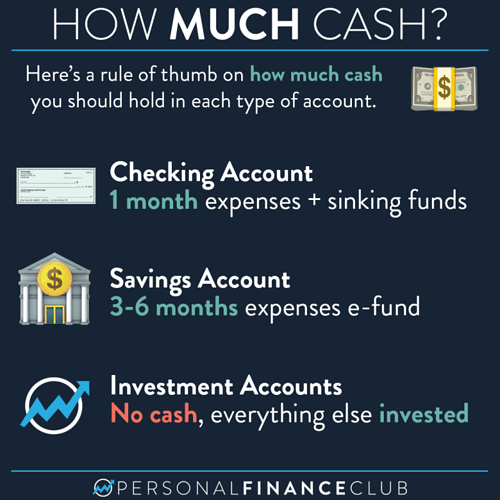

The sweet spot is in between. Keep enough cash on hand for monthly expenses and an emergency, but anything over that reasonable amount should go to investing, preferably in index funds, not a single stock! So let’s walk through this:

• Checking account. Once you have one month of expenses in here, you’re officially not living paycheck to paycheck, you can take a breath and relax and stop worrying about overdraft fees and how to pay for upcoming bills. Also in here goes any sinking funds. That’s basically money you’re piling up for a future expense. (i.e. car maintenance, holiday gifts, upcoming vacation, etc). It could end up being a decent chunk of change sitting here, but that’s ok! The point of this account is to have that money ready to spend.

• Savings account. I use this just for an emergency fund. Take your monthly cost of living, multiply it by 3-6 and stick it in a savings account and forget about it. Where you fall on that 3-6 months depends on you volatile your employment is, how many people are depending on your income, etc. i.e. if you’re a nurse with no kids, 3 months is probably fine. If you work in oil (and are subject to whims of the industry) and have a bunch of kids, bump that up to 6 months.

• Investment accounts. The above two accounts represent your “defense”. They make sure you’ll have cash to live, even in the face of emergency. Once those are full, time to go on offense. Start filling up investment accounts in order of tax advantage (401k match, HSA, IRA, 401, brokerage). Don’t keep cash here. Use every dollar to buy and hold index funds!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram