Originally published at: https://www.personalfinanceclub.com/how-much-of-my-paycheck-should-i-save/

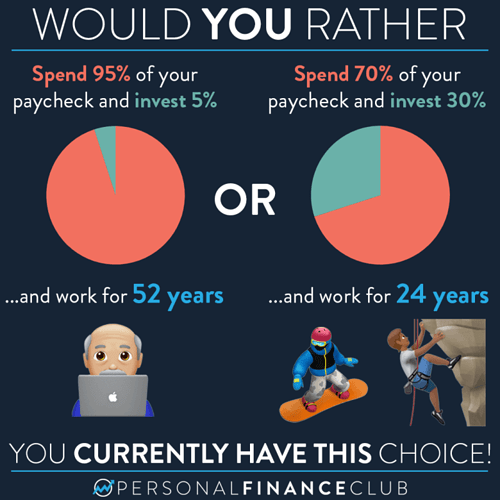

Remember retirement isn’t an age. It’s an amount of money. Once your investments have grown to 25 times your annual spending, you are financially independent and can live off your investments forever! And on the flip side, nothing magical happens at 65 that allows you to stop working. If you don’t have your money invested and working for you, you’ll be working forever. (Do you think those 100 year old Walmart greeters are there because they love spending the day on their feet at the entrance of a Walmart?!)

Spending less and investing more has a doubly effective impact. First, you’re saving and investing more to have more money later. But you’re also spending less, which brings that 25X retirement number down. Every dollar you move from the spend to invest bucket in your budget is buying you your life back!

These numbers are if you’re starting from ZERO. If you already have some money saved or invested, you may be that much closer to your financial independence number! What’s your saving rate? How close are you to FI?

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram