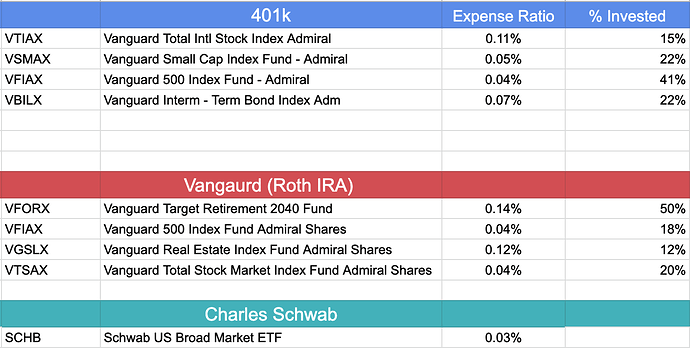

I have overlap in my investment accounts and I’d like some advice on how to fix them. I have the following index funds and one ETF in three different investment accounts. I had a target date fund RFGTX with an expense of 0.38 in my 401k, but I moved the funds into VFIAX before I took the PFC course and I decided to instead choose Vanguards Target date fund since it was Vanguard and the expense ratio was smaller.

I have about $300k in my 401k and I’m in my 3rd year of investing in a Roth IRA at $20k. As for the Roth IRA I’m almost at the point maybe 2022 or 2023 where I will no longer be eligible to contribute to a Roth IRA and will have to roll it.

Could you help me re-align these accounts to make more sense. Thanks!