Originally published at: https://www.personalfinanceclub.com/how-the-sp-500-behaves-on-election-year/

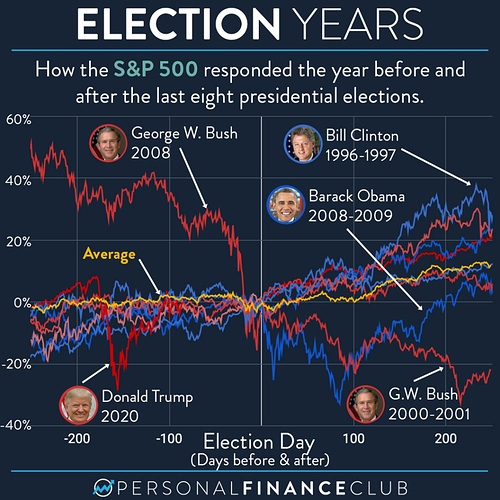

As we approach an upcoming US election, I’ve been getting a lot of questions like “should I (wait/not wait to) invest (before/after) the election?!”. Credit to @dnngn_ for giving me the idea to chart it out.

Well, here’s a look at the market for the year before and year after the last eight presidential elections. All the charts are normalized to be at 0% on the election day, so you can see the gain/loss over the previous year and following year.

You can see George W. Bush has the unfortunate honor of starting his presidency during the dotcom crash and ending it during the financial crisis. Donald Trump has has presided over the Covidcrash of 2020 (it’s yet to be seen where the market will end in November). And Clinton oversaw the market during the dotcom boom of the late 90s.

So what does this all mean? Well, if you can look at these charts and draw a conclusion other than “it usually goes from the bottom left to the top right”, I think you have a future in professional Rorschach testing, cloud animal spotting, or political punditry. And even if there is a trend (the average does seem to dip a LITTLE in the month before the election), that is much more likely due to randomness (it’s only eight elections we’re looking at after all) than it is to be predictive of the next election market.

Remember that everyone else has access to this information too. So even if you COULD predict a change of a couple percent (still not worth it), that information is now “priced in” to the market in a way it hadn’t been in the past years before the trend formed.

So the moral of the story? Ignore the market. Buy and hold index funds. Don’t sell anything until you retire. And vote.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram