Originally published at: https://www.personalfinanceclub.com/how-to-calculate-tip-total-interest-percentage-when-financing-a-home/

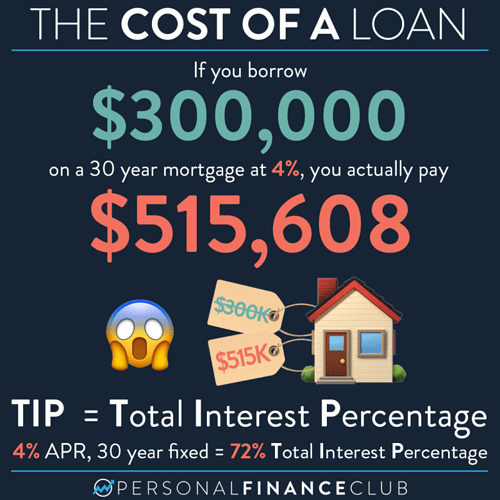

A friend called me yesterday (like actually called, not texted… yeah, I know, I was freaked out too). He asked me if I knew what TIP was. He was looking at his mortgage details and shocked at the total amount of interest he was going to pay over the life of the loan! I had never heard of the TIP acronym before, so I thought I would share!

I think this TIP number can be shocking because mortgage rates are at all time historic lows. (Did you know the average mortgage rate in 1981 was over 16%?!) But today, it almost feels like “free money”. But just as investing can benefit you with the awesome power of compound growth. A long term loan can burden you with the weight of compound interest!

How do you reduce the TIP? Basically, borrow less money or pay it off faster. Spending less on your home will help you accomplish both.

There is a reasonable school of thought that you should pay off your mortgage as slowly as possible as the money can be invested and get a greater rate of return in the market. I don’t think that’s a bad idea, as long as all your other debt is paid off and you have at least 20% equity in your home. But either way, spending less on your primary home will open up even more of your income to investing and building wealth!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

p.s. I’m curious if people will yell at me in the comments for saying that renting is always better on this post. Because, you know, I literally never say that.

via Instagram