Sup PFC Fam!

I’m now eligible to contribute to the 401k at my new job and there are several mutual fund options, all with various performances/allocations/fees etc.

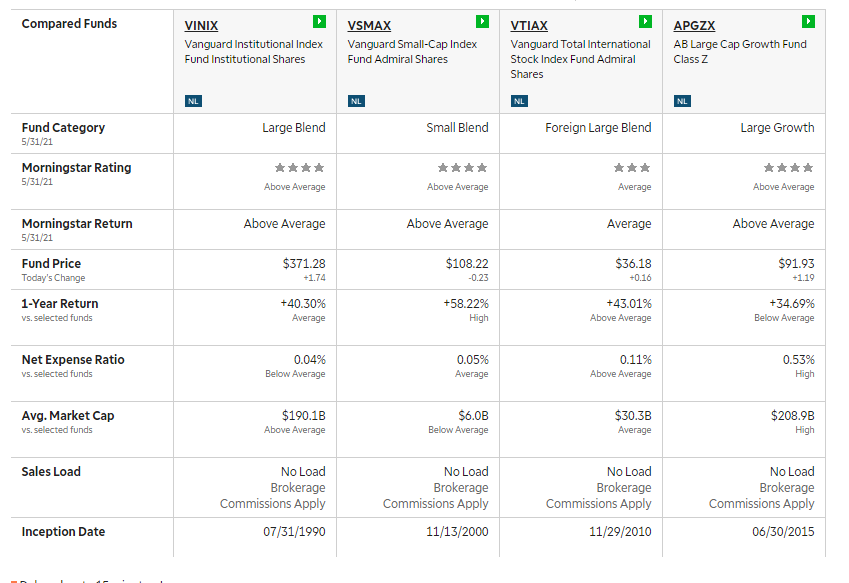

So far I have narrowed it down to 3 Index Funds ( All Vanguard ) and 1 Mutual fund that has the lowest expense ratio and best performance.

I’m currently thinking an allocation like this:

*VINIX - 70%

*VSMAX - 10%

*VTIAX - 10%

*APGZX - 10%

Since I’m going to Max it out HAM style! , I would like to get other opinions on how to better allocate it.