Hi Jeremy,

I just opened an investment account inside my HSA with Mybenefitwallet and found out after that they charge a flat fee of $2.90/month for the account (regardless of the number of transactions or positions I hold). There are no transaction costs or load feels when I buy mutual funds.

Do you think that the fees are a little too high? Should I close the account or stick with it? Then move everything over to my Roth IRA when I leave the company?

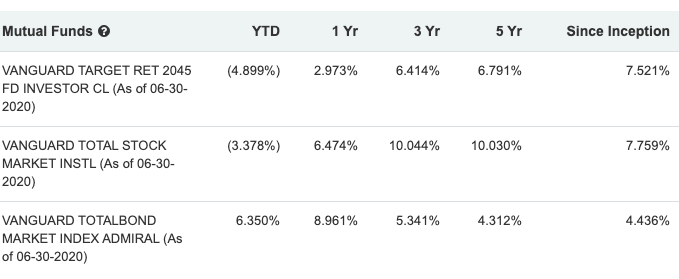

Attached is a screenshot of the mutual funds I that I selected. The options were limited, but I stick with Vanguard as you normally recommend. What do you think of my selection?

Thanks,

Greg