Originally published at: https://www.personalfinanceclub.com/if-you-dont-want-to-work-forever-spend-less-and-invest/

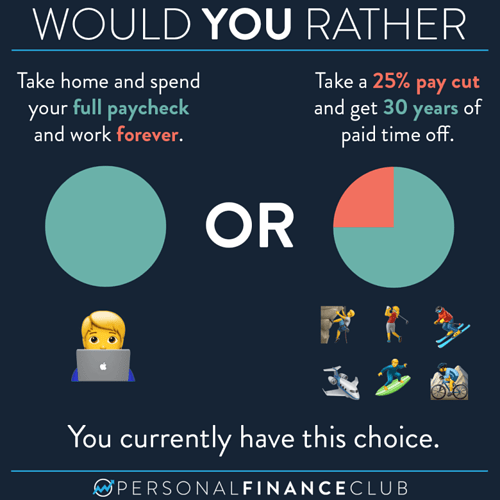

If you don’t invest, you will never have enough money to retire. That means working until you die, or at least until social security kicks in then living in poverty at a fraction of your current standard of living.

But if you’re starting with nothing and invest 25% of your salary, in 27 years your investments will have grown large enough to support your same cost of living forever. Depending on how long you live that could mean 30+ years of paid time off!

If you want to retire even sooner, spend less and invest more! Lowering your cost of living and increasing your investing has a two fold effect, further accelerating your path toward financial freedom!

For sure figuring out how to lower your expenses and increase your income is the hard part. The logistics of investing are as simple as clicking a few buttons on a website. I could literally teach you everything you need to know about investing for the rest of your life in six hours.

Well guess what. That’s exactly what I do in my “how to invest” course. It’s a fraction of the cost of a single community college credit and all it does is make you into a millionaire. Click here to check it out!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram