Originally published at: I’m a millionaire and this is my net worth by age – Personal Finance Club

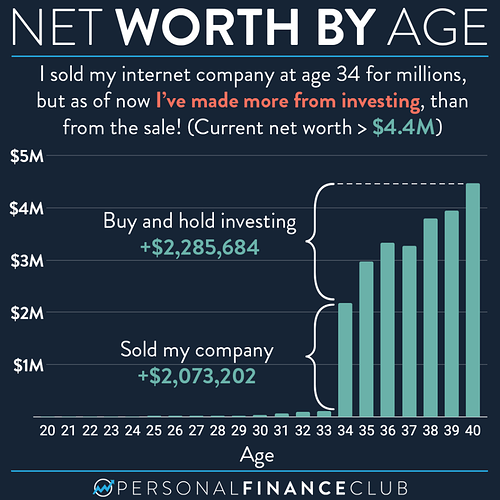

I thought this was kind of an interesting way point on my financial journey. While it certainly feels like I made most of my wealth when I sold my internet company at the age of 34, I’ve actually made more since then, almost exclusively from buy and hold investing!

How did I do that? Well, when I sold my company I ended up with about $2M in the bank after taxes. I dumped that money into a few index funds in the stock market. The stock market has more than doubled since then, and here we are!

Interestingly, if I had dumped every penny to my name in an S&P 500 index fund in April of 2015, today that investment would be worth $5.1M. About $600K ahead of where I actually am! Why am I behind that pace? Well, I didn’t do 100% S&P 500. I took a more diversified approach that included international stocks, some bonds, and a personal residence (as of about two years ago).

It JUST SO HAPPENS that large US companies have been a fantastic asset class over the last seven years, but I couldn’t have known that was going to be the case when I set my asset allocation. And starting today going forward, we certainly don’t know if that will continue to be the case for the next seven years, so I’m sticking with my original plan!

It’s also notable that this performance isn’t exceptional. In fact, it’s pretty average. Over the last 100+ years the stock market has generated annual returns of about 10% per year. At that pace, an investment will double in value after about seven years. I dumped my big lump sum into the market over six years ago now, so I’m just about on the expected pace! In another seven years, I hope to double again or better!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram