I just found out I need to purchase a full (voo) stock everytime I want to buy. I always see these things about putting 10$ a day into an index fund for 40 years and having 1 millions dollars. Am I doing something wrong? And I have a non retirement brokerage account is that what u suggest having?

Hey Tanner!

So you’re investing in ETFs, which are just like index funds, but you have to buy them in “full shares” as you’ve discovered. I think it’s a bit easier to invest in traditional index funds where you invest in dollars. And you can do the $10/day thing assuming you start with at least the fund’s minimum (although investing daily is kind of overkill. Monthly is fine).

There are also many brokerages (e.g. M1 finance, Betterment and many others) that allow fractional purchases of ETFs. That would also allow you to contribute $10 at a time.

And you mentioned you’re in a taxable account. I’d want to put my first dollars each year into tax-advantaged accounts to minimize future taxes on the growth of your investments! This page breaks down that order:

Does vanguard offer these index funds or just ETF’s? What exact account would you suggest I have through vanguard?

I have a 457 through work that’s maxed 19500 a year and I just started a Roth IRA through vanguard that I will also be paying the max 6k a year. I’d like to purchase index funds on my vanguard account As well that wouldn’t be as consistent. What account would you suggest I do that on? Is my current account fine or do u need a particular one to buy the traditional index funds?

Hey Jeremy,

Who should I use to buy traditional index funds? Does vanguard do that? The account I have only lets my buy full ETF’s of voo. I want to be able to buy partials.

Since you’re already using Vanguard, I’d stick with it! You can open a Roth IRA and a regular brokerage account and buy index funds inside of BOTH of those accounts!

Vanguard absolutely offers index funds (they invented index funds as it happens). I’d suggest a target date index fund. There are ticker symbols for Vanguard at the bottom of that article.

So I spoke with vanguard in order to be able to purchase partial shares of VOO id need to put 3k in my account to start. To start a target index I’d need to put 1k to start it. Which is fine does this sound correct? Got the roth started and putting the max starting next check. So I’ve got a 457b and a Roth IRA both maxed which is 25500 per year but I think I can save about her 10k just need to figure out this index (voo) and the target index thing.

I’m still unclear on what I need to do to purchase an index fund in my account. I’m sorry for the questions as I’m extremely green at this stuff. Thank you.

I would go with the target date index fund! It’s the easy “set it and forget it” option that is basically optimal investing.

Check out this post that helps walk through the process of buying a Vanguard index fund:

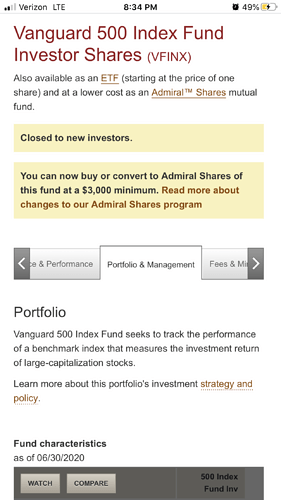

Is the S&P 500 index fund “admiral Shares” The same thing as VFINX? It says VFINX is closed to new investors. What is the s&p 500 index fund ticker through vanguard that you suggest I use? I’m doing a target index fund as well.

VFINX is the very first index fund… started in 1975! But it’s kind of a historical relic at this point, as it has higher fees than the more modern index funds.

I’d skip an S&P 500 fund and instead invest in a US Total Stock Market Index fund, like VTSAX. If you own a target date index fund, you already own that (and the S&P 500 as well) so it doesn’t really get you anything new. You’re just doubling up on US stocks at that point.

First time post here. I’m focused on optimizing my finances and furthering my financial knowledge. Is there anything on Vanguard that I cannot do in my ETrade?

Additionally, I exceed the Roth IRA income threshold. Does a Traditional IRA have a salary cap? I see these steps you’ve outlined asks you to pick between a Roth IRA or Traditional IRA.

Traditional does have an income cap lower than that of the Roth IRA. But you can make a “non-deductible” contribution to a Traditional IRA at any time. You can then convert that traditional IRA to a Roth IRA, in a process known as a “backdoor Roth IRA”. If you’re in that income bracket, it’s probably worth talking to a CPA about your tax situation.

I believe ETrade will generally do anything a Vanguard account will do. (I think you can even buy and hold Vanguard mutual funds inside of an ETrade account). I’m not super familiar with E*Trade and if there are other fees involved though.