Good afternoon Jeremy, I have a question and was wondering if I could get your input. Been following you for a few months now ever since you did the Market Monday’s on EYL. I have been investing and day trading for a few years now and making modest gains. I own a few indexes, some apple stocks and a few other tech stocks. I’m currently looking into some income funds with monthly dividends. Specifically PDI and CRF. Just looking off their track record and the holdings they own they seem like some solid funds to generate some good monthly dividends. Question for you is do you think it’s wise to diversify in income funds or rather keep doing indexes? I feel like I know what your going to say but figured I’d ask anyways.

Welcome @Joose2020!

So some of the principles of Personal Finance Club are “Invest in index funds”, “Buy and hold”, “Minimize fees”, and “Simple is better than complex”. Those aren’t the principles because we’re just trying to save time (although it does save time). Those are the principles because doing those things will make you the most rich. Any sort of day trading, picking stocks, picking funds, switching strategies, chasing dividends, etc. just opens you up to underperforming the market. It adds complexity, without adding better expected returns.

To break down the funds you mentioned:

- PDI (PIMCO Dynamic Income): Researching this ETF already makes my head spin which is a bad start. It uses leverage to seek higher returns (i.e. paying interest to borrow money to internally invest more money). And it looks like it invests in a bunch of different bonds, some of which are junk bonds. Lots of things there set off warning bells. I talk here about why I would never hold a leveraged fund. And to top it all off, I think PDI wins the award for the highest expense ratio I have ever seen. A whopping 3.96%. That means every year they take a whopping 4% of your money no matter how the fund does. About half of that is paying interest on the leverage, and the fund manager pockets the other 2%. It’s straight up bonkers.

- CRF (Cornerstone Total Return): This one has an expense ratio of “only” 1.17%… (I consider anything over 0.25% to be high, and try to keep it around 0.1% or lower. This one owns about 100 stocks, mostly very large US companies. I don’t know why you would ever pay 1.17% of your money for that when you can buy all those companies virtually for free in any index fund.

Since the market is efficient, studies have shown that the only thing you can do to reliably predict better future performance is to minimize fees. The above ETFs definitely don’t qualify.

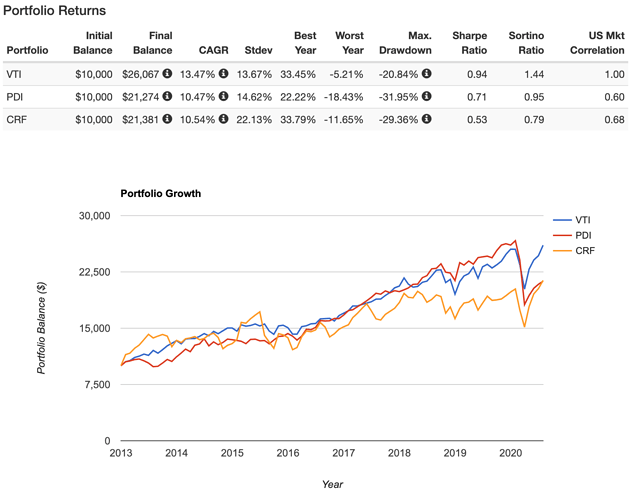

So given that, let’s see how they actually did against a low fee index fund (I used VTI in this case):

You can see over the longest time frame for which data is available (only about 7 years) they have both managed to underperform the market by about 3% per year. And I’m afraid you found those based on their good performance. ETFs and mutual funds generally disappear after they’ve had bad performance, leaving just the lucky few that did well (based on luck and survivorship bias, not skill). So if you chase that past performance and buy after the great performance, you’ll own just in time to underperform the market going forward. (You can see both funds had a brief moment of glory, outperforming the index, but time always wins and fees always erode away that outperformance).

You mentioned monthly dividends. I don’t chase dividends (even if you want monthly income). Here’s why:

I also just guest hosted a podcast on the same topic here:

So what do you do? If you’re going down the ETF route, I’d suggest a three-fund portfolio. You can own the full market (and collect all the dividends produced within) at lost cost with maximum simplicity. This is the kind of advice that everyone who knows that they’re talking about and isn’t trying to sell you something will give you. Check out 3-fund portfolios here: