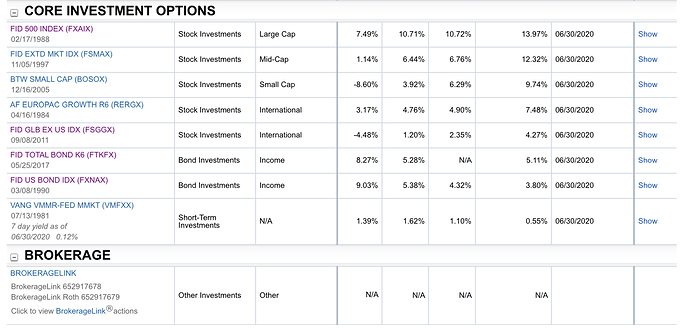

Hi, Jeremy! My employer offers some targeted date funds but those aren’t index funds unfortunately. We also have options to choose individual funds in this pic. I am not sure which ones to choose and what % I should invest in each funds. I’d appreciate any suggestion. Thank you

Hey @Mamabear!

So when picking investment options from those given in a company sponsored retirement program, like a 403b, my order of preference is:

- Target date index fund (expense ratio < 0.25%)

- 3-fund portfolio of index funds (expense ratios < 0.25%)

- Target date fund

- 3-4 diversified mutual funds

While you reported that option 1 isn’t available, the good news is that option 2 is, which is just as good! (Just requires picking 3 funds instead of 1). So if I were to implement a 3-fund “aggressive” portfolio that’s 90% stocks and 10% bonds, with those options, I would probably do:

- 45% FXAIX (Large US stocks, expense ratio 0.015%)

- 11% FSMAX (Medium and small US stocks, expense ratio 0.046%)

- 34% FSGGX (All non-US stocks, expense ratio 0.056%)

- 10% FXNAX (Bonds, expense ratio 0.025%)

Since you don’t appear to have a “total US market” index fund, the 3 fund portfolio became a 4 fund portfolio so we can include small US stocks in the mix. Notice how all those have super low expense ratios! That’s awesome!

You could even drop small US stocks and go 60/30/10 or something like that if you like more simplicity. If you’re older or otherwise want to be more conservative, you could crank up the bond fund and lower the stock funds proportionally. Getting the percentages exactly right isn’t a huge deal. The bigger deal is a coherent allocation, then setting it and forgetting it and dumping a lot more money in

Hi Jeremy,

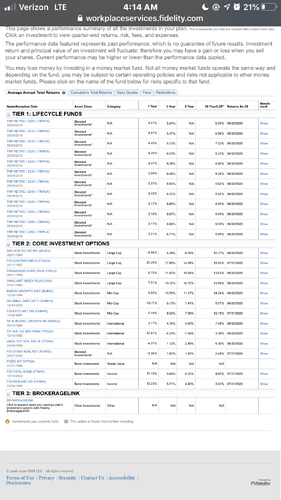

I need help with this also! I read your post on how to choose 401k investment options and the posts here about it but I just wanted to double check if I’m doing this right. I’m just starting my 403b and these are my options. I have a target date fund of 2060 (TRPLX) available but the expense ratio is 0.5 (no index target date available). I was thinking it would be better to do VIIIX? Is this a bad idea?

What is the difference between large cap and mid-cap categories?

I ended up doing 60/30/10 method to keep it simple. I will automatically invest and forget about it for a long time. From Jeremy’s answer, I would guess Shelby could do the same VIIIX (60%)VTSNX(30%)FXNAX(10%)? Or include one of the mid cap index one(FSMAX) to do 45/11/34/10. Don’t listen to me, Shelby and let’s wait for Jeremy to answer. I am still learning

I love it! That will make you rich!

@Mamabear nailed it! I actually looked at your options first, then checked what she said and we had the identical portfolio. That’s a really nice 3-fund portfolio with super low expenses.

- VIIIX (60%)

- VTSNX (30%)

- FXNAX (10%)

Exactly what I would have said. You’re a rock star @Mamabear!!!

Thank you soooo much! Still have lots to learn but you’ve been so helpful Jeremy! I’m inspired!