Originally published at: https://www.personalfinanceclub.com/ira-vs-401k-and-roth-vs-traditional/

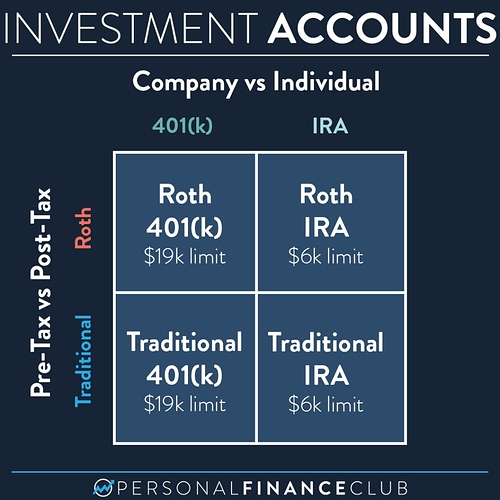

All four of these types of accounts exist:

- Roth IRA

- Traditional IRA

- Roth 401(k)

- Traditional 401(k)

I think the terms can confuse people so let’s break it down.

An IRA is an Individual Retirement Account. It comes in two “flavors”: Traditional and Roth. Both IRAs have a contribution limit of $6,000 in 2020. The difference is just the tax status of the contributions. In a Traditional IRA, when you contribute money, that money goes straight in and is not taxed the year you make it. Then when you withdrawal the money later in life, you pay tax on ALL the money as though it’s your income. A Roth IRA is the opposite. When you contribute, you’re using post-tax money to fund it, but that money is never taxed again as it grows. When you withdraw it later in life, it’s 100% yours. Both types of IRAs are held in your own account in your own name, just like your checking or savings accounts.

A 401(k) is an employer sponsored retirement account. You can only open one if you work for a company that offers it as a benefit. 401(k)s come in two flavors: You guessed it, Traditional and Roth. Both 401(k)s have a contribution limit of $19,000 in 2019. The tax statuses for the 401(k)s are exactly as above. Traditional is not taxed now, Roth is not taxed later. Most 401(k)s are Traditional, but more companies are offering the Roth version now too.

So when someone says “I need to open a Roth” that doesn’t REALLY make sense, because Roth is just a tax status, not the name of an account. It would be more correct for them to say “I need to open an IRA with the Roth tax status”… or you know, a Roth IRA.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy