Hi PFC Community,

I’ve been following Jeremy on IG for a few months and just signed up to his forum, glad to be here!

My wife and I have been maxing out our 401ks for a few years now and I’m 36, we’ll increase the contributions to hit the new $20.5k next year. Those are in a good place for our age. We make the yearly $6k/yr deposits into our IRAs as well. The house is almost paid off and we’ll be debt-free soon. I want to start putting the remaining cash we save each month into a brokerage account, putting those funds into ETFs on a monthly basis and just do dollar-cost averaging.

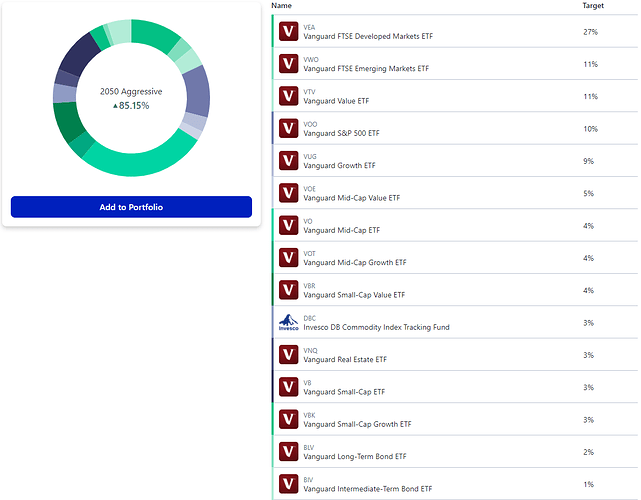

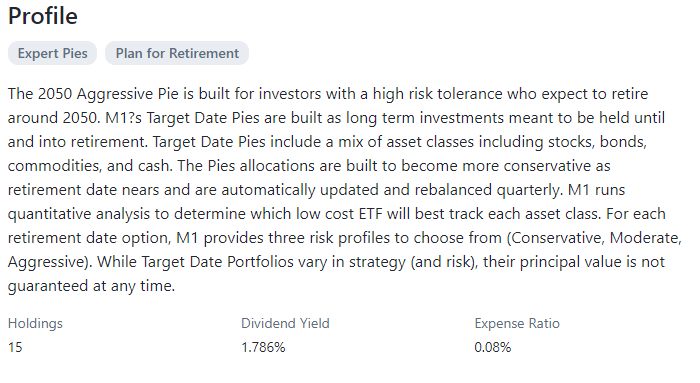

Is putting 100% of my ETF strategy into VOO a bad move and what kinds of risks could that have? The expense ratio is so small at 0.03% and the yearly gains have been 16% since inception. The S&P obviously won’t go under and I know there will be some down years, but it seems like the safest bet and just letting it ride until retirement. Everyone says to diversify but the other ETFs cost more and include most of the same stocks, unless I went to Bond ETFs…

I see a post from Aug’ 2020 where Jeremy says he likes VTI better. It has the same expense ratio but only 9% gains since inception.

Please let me know your thoughts, appreciate it!

-Ian