Originally published at: Is a financial advisor worth the fees? – Personal Finance Club

If you have $100,000 to invest and you go to a financial advisor who charges a 2% fee, they’ll take $2,000 per year. That’s a lot in fees, but from the financial advisor’s perspective it’s still a lean living. They have to pay office rent, salaries, insurance, technology, etc.

If you have $10,000 to invest, a 2% fee is only $200. A financial advisor simply can’t stay in business charging only $200. So if you are investing that amount (or less) the financial advisor has two choices: 1.) Kindly explain that they can’t make you more money than the fee they would have to charge you and send you on your way. Or 2.) charge you WAY MORE than 2% in fees (often without clearly disclosing how much those fees add up to).

When I get asked “how do I find a good financial advisor”, my answer is something like “I can’t tell you how to distinguish between a good financial advisor and a bad one, without teaching you how to invest. And once you know that much, you may not need a financial advisor at all“. That is even more true if you are investing less than six figures. It’s just a tough business model with the inherent conflict of interest of charging someone to help them make money.

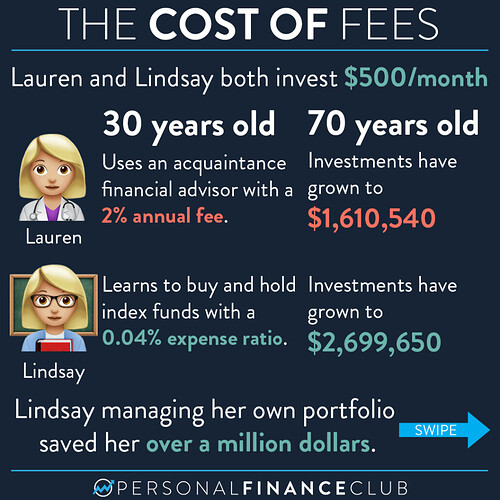

And as this graphic shows, even if you are investing big money, the impact of those fees over a career of investing can be devastating. The miracle of compound growth is crippled when those top percent or two is shaved off the top.

That’s why I made my course. It’s an A-Z walkthrough for everything you need to know to buy and hold index funds without sharing a percentage off the top. There’s no secrets. It’s the same information you find on my page and in the classic books on investing. So far thousands have signed up and and the reviews are insane averaging way over 4.9 out of 5 stars!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram