Originally published at: Is buying a home a good investment? – Personal Finance Club

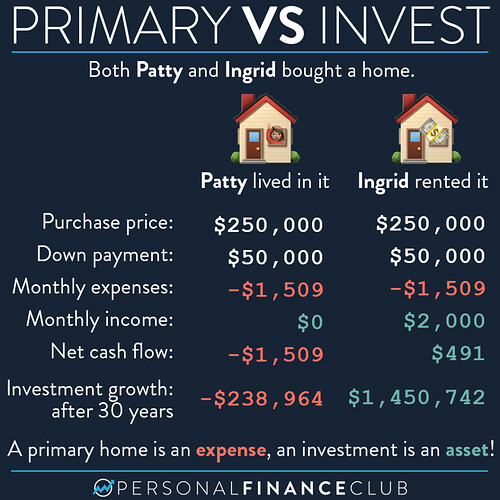

This is obviously comparing apples to oranges. Because you get to live in your primary residence and you can’t live in an investment property (ignoring the house hacking hybrid for now). But still it paints a pretty striking contrast. Financially, ORANGES ARE WAY BETTER. When thinking about how to direct your money, don’t dump it all into your primary residence. Use some of it for investing!

Investment real estate offers a fantastic opportunity for wealth building with these FOUR engines of wealth creation:

1. Cash flow (You get paid monthly)

2. Appreciation (The home goes up in value)

3. Debt paydown (The loan goes down in value paid by the renters)

4. Depreciation (A tax advantage while you own the investment property)

Additionally, investment real estate has one big advantage over stock investing. You can use a government sponsored 30 year mortgage to create leverage! As in this picture, Ingrid only puts $50K down but owns an asset appreciating and getting rental income at the rate of a $250K asset. That leverage does involve risk… if home prices drop by just 20% and Ingrid has to sell, she would lose all her money instead of just 20%. But the upside is magnified as well. So, as a part of a careful investment plan, borrowing some cheap government money for an investment property can magnify future wealth!

Note that usually doesn’t work for a primary residence. If you borrow more to buy more and have no income from it, that just means more expenses and costing you more in the long run.

And of course, this has nothing to do with renting. It doesn’t mean buying is bad. It just means to focus less of your dollars on your primary home and more on your investments! (Queue people yelling at me in the comments about renting for some reason)

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram