I am about halfway through the course and would like advice on my current situation. I am 41, I have roughly 58k in a rollover IRA, and 38k in a rollover Roth with my financial advisor. My job just started offering a 401k and Roth 401k with a 4% match.

I chose the 2050 target date fund SSDLX and I currently contribute 6% to 401k and 6% to the Roth 401k. I also still contribute 250 a month to the Roth with my financial advisor.

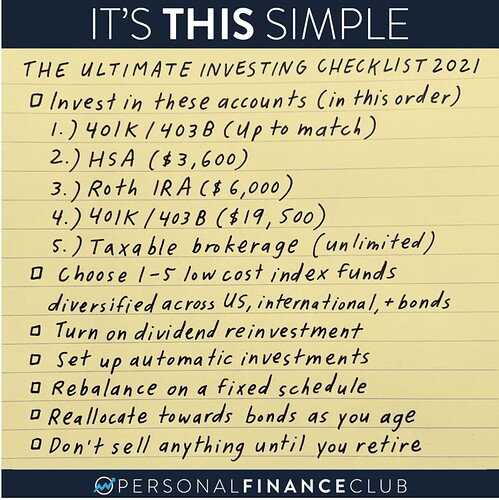

What is the best move to gain the most in the next 25 years? Is SSDLX a good choice to keep contributing to? There is also an index fund SSSYX. I may even be able to contribute more per paycheck, should I put everything to the Roth 401k instead splitting it with the 401k? Part ways with my financial advisor and also start contributing to an index fund outside of the employer plan?