Apple dominate this ETF. Do you think it’s wise to invest in a ETF that one company make up 19% of the ETF.

Hi Mike! If you were intending to link a certain EFT here, I don’t see it. But in general, there are many funds out there with various holdings and weights. The ones recommended (VTSAX, FZROX, etc) on the site are organized to have a structure and weighting to mimic the S&P500. Others, like the Target Date Index Funds, will be structured with risk tolerance in mind according to the date on the fund. The farther the date is out now, the more risk or volatility it will represent.

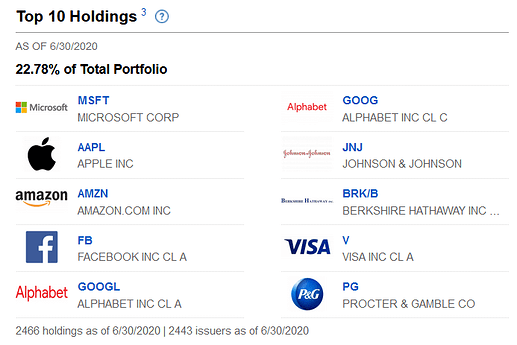

Take for example FZROX, below are its top 10 holdings making up nearly 23% of the portfolio:

This is far more diversified than the one you are seeming to cite, which has a 19% holding in Apple alone. While it is your money and risk tolerance, I think that recommending you to invest in a heavily weighted ETF like that would be very risky.

@dgurgan, I think you missed the ticker symbol in the title (FTEC).

@mikesaunders, that’s a technology ETF. I get a lot of questions recently about technology ETFs/index funds/mutual funds, because looking backwards they have recently outperformed. But basically, I think going after a fund like that is just “chasing past performance”, but we have no reason to expect it to outperform going forward. So no, I wouldn’t buy that ETF, I would invest in a total market, low fee index fund.

Here’s a couple more detailed answers I gave to a similar questions: