Originally published at: https://www.personalfinanceclub.com/jeremys-2020-investment-performance/

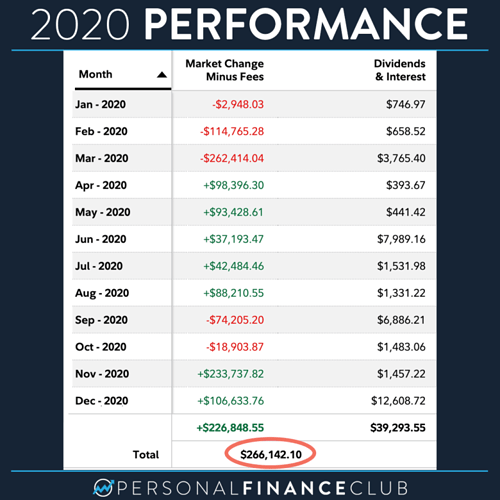

This is a screenshot from my actual Fidelity account showing the performance of my investments in 2020. I made zero trades last year (other than some normal buying of the same funds). I didn’t time the market. I didn’t pick stocks. I didn’t try to avoid crashes. I just let the investments sit there and do the work.

And it was a bit of a wild ride for sure. It wasn’t super fun to check my balance at the end of March and see that I was down $380,000 on the year. And things were scary then. We all knew the pandemic was gonna get worse. We all knew the economy was gonna take a hit. We knew stores and restaurants would close.

But I knew all of that information was already “priced in” to the market. The price of the market was low because of all those bad expectations. I had no way of knowing what would happen to the market after March because I didn’t have any knowledge that the sum total of humanity didn’t. So I did nothing. I let the market do its thing.

If I had sold in March I would have ended the year down $380K. But since I did nothing I finished up $266K.

Will I finish up in 2021? I don’t know! Probably. The market has been up about 70% of years in history. And either way as long as I hold my shares I’m collecting my dividends (over $39K last year)!

If you’re wondering why these numbers are so big, it’s because my average balance last year was a bit over $2 million. If you’re wondering why these numbers are so small, DM me I have a ponzi scheme I want to sell you.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram