Can someone please give me some insight on M1Finance’s Target Retirement Fund?

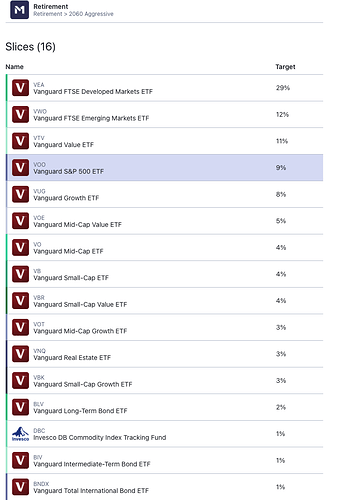

I’m a big fan of Target Retirement Funds and I like M1Finance’s user features BUT I just want to know why M1’s 2060 Retirement Fund has 16 holdings vs. Vanguard’s 2060 Retirement Fund which only has 3.

The performance of both seems to be similar so I’m assuming they have very similar holdings.

But I just want to learn more so I will know exactly what I am investing in!

Thanks!