Hey @jenniferc2011!

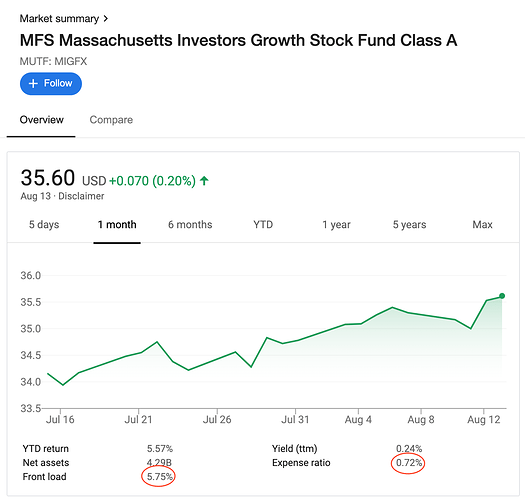

I hate to accuse your financial advisor of screwing you since they’re just a business trying to help people with money and pay their bills and stuff. But to maximize your own self interest, I’d avoid high fee funds like that. (And I’m afraid the news is actually worse. I think you’re also paying a 5.75% front load fee every time you invest… and I bet you’re also paying a regular account fee on top of the other two fees)

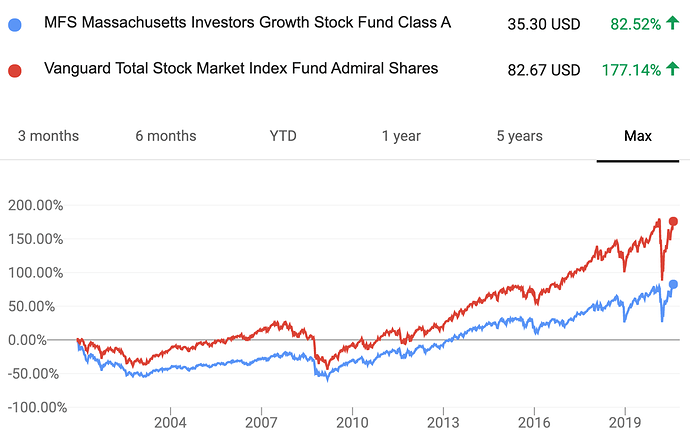

And for all those fees, it’s actually significantly underperforming the market:

I think a three fund portfolio is excellent. Personally, I might opt for a target date index fund for a single set-it-and-forget-it option. That article has Fidelity ticker symbols at the bottom. They offer expense ratios of 0.12%, no load or transaction fee and no account fee.