Hi Jeremy,

Apologies in advance for my 3 part question.

My company offers me a Roth 401K. I have begun to learn that investing in Dave Ramsey’s investment strategy won’t yield better returns than the S&P 500.

My partner and I are still very new to investing and would like to park our money in a target-date fund as you recommend.

Anyways, when going to change my Roth 401k investments, my options are very limited. I plan to withdraw from my Roth 401k at age 59.5 (2057).

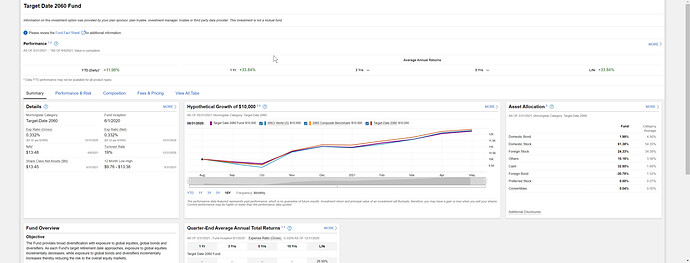

My employer is only allowing me to do a different 2060 TDF than FDKLX. Can you point out what stands out to you that’s different from FDKLX? Do you still think that is the ideal option?

Pics below to compare FDKLX (Fidelity Freedom Index 2060 Fund - Investor Class) to Target Date 2060 Fund

(System wouldn’t allow me to upload the second image /: )

(Some of the things that stick out to me is the higher expense ratio)

My second question is since my HSA investing won’t be accessible till age 65, I believe I should park my investments into a 2065 TDF (FFIJX), would you agree? I won’t be able to withdrawal from it until after 2060 hence why I rounded upward. Do you think I should invest in the 2060 TDF (FDKLX) instead?

Bonus question: What is the Target Date Income fund? (I have never heard of it)