Originally published at: NEVER buy whole life insurance.. here’s why. – Personal Finance Club

I’ve never met a permanent life insurance policy that I didn’t dislike. This applies to every name they’re called including whole life, universal life, indexed universal life (IUL), variable life, etc. Basically any insurance policy that accrues a cash value and is masquerading as an investment necessarily MUST underperform the underlying investments to make room for the insurance company’s profits (and large sales commissions) or else the insurance company would go out of business.

The salespeople who push these policies (who often confusingly will call themselves financial advisors) will tout all sorts of benefits. Tax deferred growth, infinite banking, avoid estate tax, stock market returns with no downside risk! It’s an enticing sales pitch. It’s all nonsense.

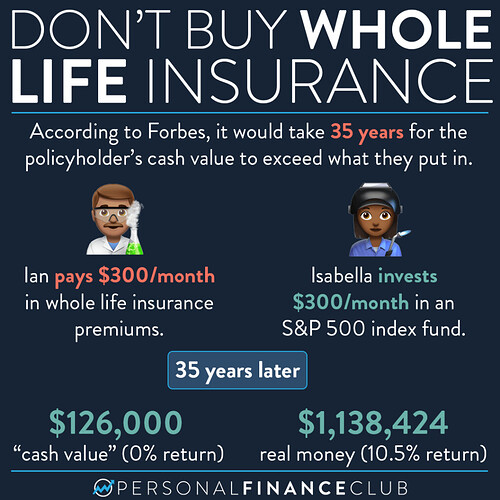

Here’s the reality on the ground. Every time I see one in real life the policyholder has paid WAY MORE MONEY into it than it’s currently worth. These policies are designed to crush unsuspecting young investors with fees that far exceed any upside growth potential. And trying to figure out what you’ll make is like trying to figure out a carnival game that’s described in a thick book of complex rules designed by the insurance company to (surprise surprise) maximize their self interest. Investments are supposed to go UP in value, not funnel fees to an insurance company.

If you need life insurance (because someone is depending on your income to live) buy an inexpensive term life insurance policy. Take the rest of that big chunk of money the insurance salesman wants to charge you in premiums and invest it in a real investment, like index funds!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

Source: Guide to Whole Life Insurance, Forbes

via Instagram