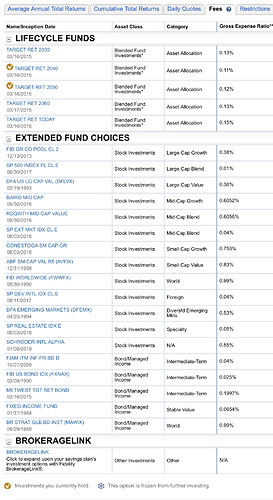

Those are awesome investment options! When I see a list like that I know someone at the company who set up the 401k had the employee’s best interest in mind. So good job to your company’s leadership!

That said, you have the best available option: A target date index fund! I’d put 100% in a single target date index fund. Spreading it out doesn’t buy you anything. i.e. a 2050 and 2040 have the same stuff so now you’re just mixing more of the same stuff with the same stuff.

I’d choose the year based on your birth year +65. I like to round up to the next available year to stay a little more aggressive for a little longer.

Regarding the expense ratios, all those expense ratios fall into the category of “very low”. So low, that it doesn’t really matter. The reason the S&P 500 is a little cheaper is because it’s a little simpler. It just has 500 US stocks. The target date fund likely has many thousands of US stocks, international stocks and bonds. Just the nature of running that fund is slightly more expensive than the very simple S&P 500. But broad strokes, I believe the diversity is well worth the tiny difference in fees.

Here’s a video on S&P 500 vs TDIF: