Originally published at: Roth IRA vs brokerage account: how much of a difference do taxes make? – Personal Finance Club

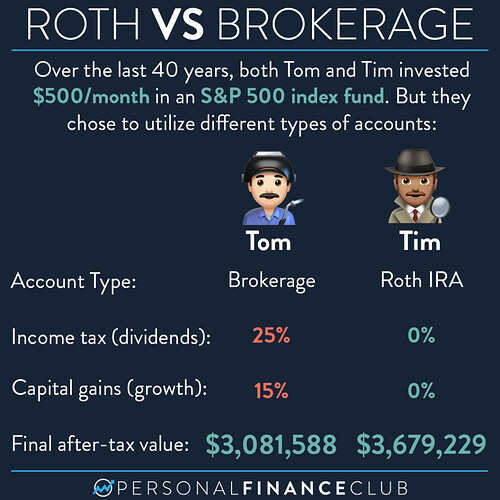

There are a few important takeaways here. First, if you invested $500/month in an index fund over the last 40 years you would be very rich no matter WHAT type of account you invest in. Sometimes I hear about investors who are so worried about taxes they forget that you’re only taxed on the GAINS. That’s a good problem to have. Personally, about 95% of my money in a regular, taxable brokerage account. That’s because I have too much money to fit into tax-advantaged accounts! (Another good problem to have).

But here’s the other takeaway. If you can use a Roth IRA, you should! In this example, it saved our friend Tom about $600K. That’s a lot of post-tax cheddar in your pocket, not the government’s.

Here’s how taxes work in a regular taxable brokerage account: You get paid and pay income tax. With what you have leftover you invest in a brokerage account. Then each year you get a tax form that says how much you collected in dividends, and you pay tax on that amount. Then when you sell your investment, you get a tax form that says the total amount you gained on that investment and you pay capital gains tax on that. You get to keep what’s leftover.

Here’s how taxes work in a Roth IRA: You get paid and pay income tax. With what’s leftover (up to $6,000/year) you can contribute to a Roth IRA. Everything inside of that account is protected from additional taxes FOREVER. (But you do have to leave the gains in the account until you’re 59.5).

So that’s why it’s great to prioritize a Roth IRA!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram