Welcome @bluszcak44!

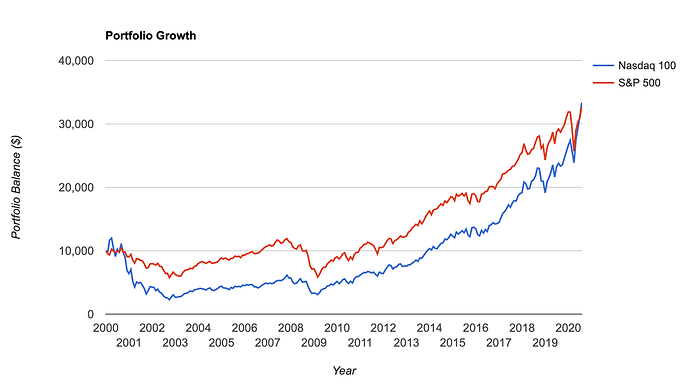

For sure, the Nasdaq 100 has outperformed the S&P 500 over certain time frames. The opposite is also true over other time frames. Here’s a look at the total performance going back to 1999 (The longest period of time the performance is available on this site):

So overall, they’re pretty close. I think a lot of people get amped about the Nasdaq 100 because it has a lot of big tech companies that have killed it the last few years (Apple, Amazon, Google, Microsoft, Facebook, etc.)

So as to why I don’t invest in the Nasdaq 100 going forward is a matter of the market being efficient. We all KNOW those great companies are in there and the prices of those companies have been bid up SO HIGH over the last few years, now going forward we have to ask, if we buy at the current high price can those returns continue to be perform above the rest of the market? The answer is, I have no idea. And neither does your friend. Since the stock market is efficient, picking and choosing stocks, or sectors, or more narrow indexes simply exposes you to greater volatility without higher expected returns. Or to put it another way, you’re just opening yourself up to underperforming the market by picking and choosing a more narrow index.