Hi Jeremy, I am looking at diversifing my Fidelity portfolio by adding a Bond Index Fund (personal brokeage account), I am 37 years old, would you rather recommend short, intermediate or long term bonds? I am not sure which one is better for me. I see that you usually recommend FXNAX, but I see that FNBGX has a higer return and similar expense ratio, so just wondering on what would be your opinion on this. Thanks in advance.

Hey @rakelroca!

Just to break down what those are a bit:

- FXNAX: US (total) Bond Index Fund, expense ratio 0.025%, 2,212 holdings

- FNBGX: US Long-Term Treasury Bond Index Fund, expense ratio 0.03%, 55 holdings

So they both buy US bonds. But FXNAX buys them of various maturities (some mature very soon, some very long) from a few different US bond issuers. FNBGX focuses on long term maturity bonds only from the US treasury.

When a bond is maturing very soon, that means the principle is about to be returned to the bond holder. So if I have a $1,000 bond and it matures in 3 months, then I’m about to get my whole $1,000 back from the US government with only 3 months to collect whatever the interest rate is. THAT means short term bonds are very safe and trade for almost exactly their face value. LONG term bonds on the other hand might vary much more dramatically in value. Let’s say I have a $1,000 bond that is paying a 5% rate and doesn’t mature for 30 years. But newly issued bonds are only paying 2%. A person who does the math would be willing to pay MUCH MORE than $1,000 for my bond because they’ll get their $1,000 back at the end of the term, plus 5% per year along the way. But the opposite can happen to if interest rates rise instead of fall

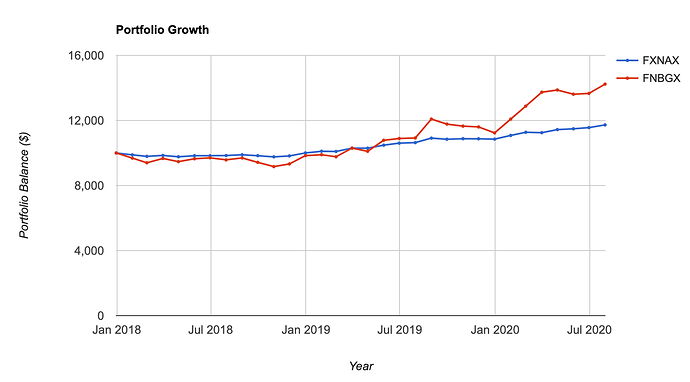

So IN GENERAL short term bonds don’t pay or go up much in value and are super safe. Long term bonds are a lot more volatile but will generally pay more over time. Here’s a look at the growth of those two funds:

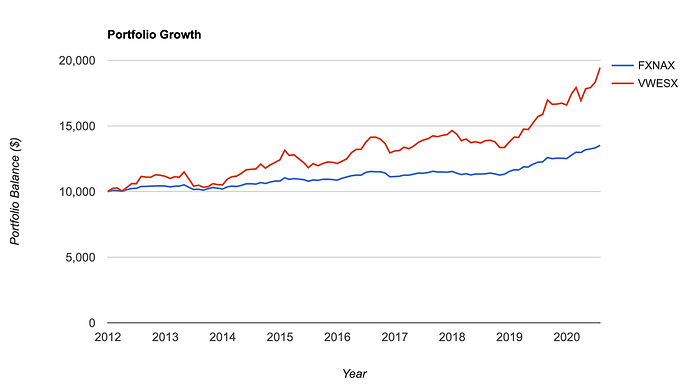

Unfortunately there’s only a couple years of history for FNBGX but you can already see that trend. The red line is more volatile (it’s below the blue line for a while) but over time provides more growth. Here’s a look at FXNAX vs a Vanguard long term bond fund (VWESX) with more history:

So same thing there… you can see the red line is lot more jagged, but ends up pulling away from the blue line.

So which one?! WELL, if you’re saving money to spend within the next few months, I probably wouldn’t go with long term bonds, because a change in interest rates could erode your money pretty quickly. (Interest rates are at crazy all time lows… if/when they go back up, it will destroy the value of existing bonds… no one will want them when the new ones pay so much more).

As part of your portfolio? The bond portion is meant to be the more stable portion to help rebalance stocks in times of volatility. A critique of FNBGX is that it behaves more like stocks so you don’t get that stability/diversification benefit. I think a bogle head might tell you to diversify across all maturity dates (like in FXNAX) to reduce risk. FXNAX also has more diverse bond issuers (548 different ones, in fact) where as FNBGX only buys from the US treasury. The diversification FXNAX offers could be a benefit if there are higher paying bonds not offered by the treasury.

But I certainly wouldn’t blame you if you wanted to choose it to be more aggressive over the long haul. Even if rates rise, as long as you keep holding the long term fund will include more and more of those bonds and pay out higher rates eventually making up for the hit in value it took. And being only treasury bonds, they’re generally considered as safe as possible since the US government is paying them back and they’re the ones that make money.

Wow @Jeremy thank you for taking the time to give me such a detailed response, I really appreciate it, it’s helps a lot.